EV Deliveries, Apple Loses $100 Billion, and a Coming AI Gold Rush?

Editor’s Note: Welcome to a new year, dear reader!

As you may have noticed, there have been some changes going on here at Street Authority.

After many years, our friend Brad Briggs has moved on to other pastures. I will be filling his mighty shoes as Editorial Director.

A bit about me: I’ve been a writer and editor in the financial publishing industry for nearly 18 years. Since 2021, I’ve served as Managing Editor of Investing Daily Insider. With that publication, I serve up a daily dose of recent financial news.

I’ll be doing something similar twice a week in the pages of Street Authority Insider. So let’s get to it!

Tesla Breaks Its Record But Falls Short of BYD

This week, electric vehicle (EV) maker Tesla (NSDQ: TSLA) reported a new delivery record for the fourth quarter. The company — which is run by love-him-or-hate-him CEO Elon Musk — delivered 484,507 vehicles in the quarter that ended December 31.

That’s more than what analysts had expected (483,173, according to Bloomberg). It also pushed Tesla to meet its 2023 delivery target despite the company’s third-quarter delivery miss.

Tesla can largely thank its price-cutting efforts for the 2023 boost in sales.

However, Tesla has formidable competition in the form of BYD (OTCMKTS: BYDDY). This Chinese automaker — which is backed by Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) — became the world’s largest EV maker in the fourth quarter by delivering more than 525,000 units.

Rivian Misses on Delivery Estimates

Also in EV news, Rivian (NSDQ: RIVN) — a U.S.-based startup that focuses on electric pickup trucks, SUVs, and commercial trucks — reported that it delivered fewer vehicles than expected in the final quarter of 2023. Rivian delivered 13,972 vehicles — 10% fewer than in the third quarter and missing estimates of 14,430 deliveries.

In part, the slowdown can be explained by the fact that high interest rates have pushed the affordability of pricer EVs such as Rivian’s trucks beyond many consumers’ grasp. Tesla in part solved this problem by initiating a price war among EV rivals.

Rivian didn’t engage in the price slashing and even canceled its entry-level vehicle in 2022. For consumers, the cheapest Rivian vehicle now starts at $73,000.

We can also attribute some of Rivian’s delivery decline to Amazon (NSDQ: AMZN), one of Rivian’s largest customers. Amazon did not take deliveries of any new electric vehicles during the holiday quarter this year.

Barclays Sours on Apple

Meanwhile, shares of Apple (NSDQ: AAPL) started the year on a sour note after Barclays analyst Tim Long downgraded the Cupertino Giant’s stock. Long is concerned that “lackluster” iPhone sales are indicative of weakening hardware sales as a whole.

“We are still picking up on weakness on iPhone volumes and mix, as well as a lack of bounce-back in Macs, iPads, and wearables,” he wrote in an analyst note.

However, Long also expressed worry that Apple’s Services unit, which accounts for roughly a quarter of the company’s overall revenue, is in for trouble due to increased regulations. Apple’s App Store policies have come under fire on claims that they discourage competition.

Anyway, Long downgraded Apple’s stock to “Underweight” and trimmed his price target by $1, to $160. That was enough to wipe roughly $100 billion off Apple’s market cap in one day.

That’s a billion with a “B.”

Will 2024 Be a Better Year?

We can all agree that 2023 wasn’t particularly great, right?

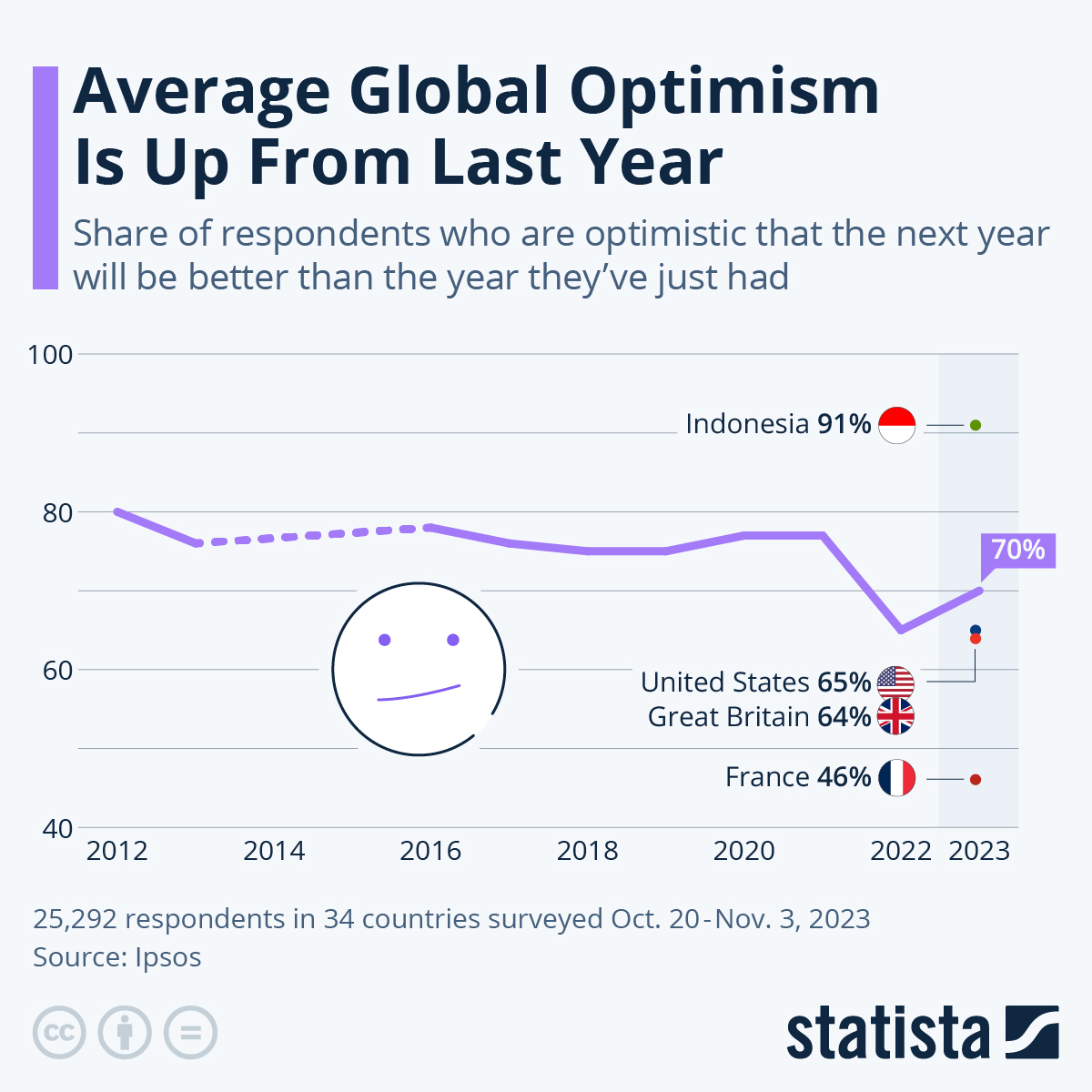

According to a survey from Ipsos, 53% of respondents said that last year “was a bad year for me and my family.” And 70% said that 2023 “was a bad year for my country.”

However, overall, optimism is on the rise. 70% of respondents worldwide believe that 2024 will be better — up from 65% in 2023.

Here in the U.S., that percentage ticks down to 65% for 2024 — although that’s better than France’s 46%.

And they have really good food and wine to boot!

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

Wedbush: Get Ready for an AI Gold Rush

Speaking of optimism, Wedbush analyst Dan Ives thinks there are plenty of gains yet to be had from artificial intelligence (AI). That’s despite the huge gains the tech sector saw in 2023 due to this trend.

“We believe tech stocks will be up 25% in 2024,” Ives wrote in a note on Monday. However, he’s predicting the sector could see as much as a 35% boost. In fact, he’s going so far as to suggest that this could be “the Year of AI.”

According to Ives, Wall Street analysts — except himself, of course — are “significantly underestimating how quickly this AI monetization cycle is playing out.” In other words, the AI rush is just beginning, according to the analyst.

He also believes that there is about to be a “tidal wave” of AI spending that will reach “the shores of the broader tech sector” this year. “The new tech bull market has now begun, and tech stocks are set up for a strong 2024,” he wrote.

As for Ives’ favorite tech stocks, they include old favorites such as Apple and Microsoft (NSDQ: MSFT), as well as Crowdstrike (NSDQ: CRWD) — a relatively recent addition to the Capital Wealth Letter portfolio. This cybersecurity stock already enjoyed a quick $100 gain in the last six months of 2023… you might want to get in on this one ahead of another coming surge.

P.S. One of the easiest ways to become wealthy in the stock market is finding stocks that pay consistent dividends — and having the patience to let them grow your wealth over time.

That’s why our team has built a solid portfolio full of market-beating yields that reward investors year after year. With a little patience (and dividend reinvestment), you could be on your way to earning tens of thousands in dividends a year.