Microchip Tech’s White House Investment, Online Shopping, and Calling It Quits on Streaming

Editor’s Note: Thank goodness it’s Friday, am I right?

Somehow we’ve survived the first week of the New Year. Going back to work after the holidays is always a challenge, even if we love what we do.

This was me on Tuesday:

Anyhoo, let’s get to the headlines!

Microchip Technology Gets a $162 Million Investment From the Gov’t

Yesterday, the U.S. Commerce Department announced that it has awarded its second CHIPS and Science Act award.

The winner is Microchip Technology (NSDQ: MCHP), an Arizona-based chipmaker, for $162 million.

$90 of the money given to Microchip has been earmarked for improvements to the company’s factory in Colorado. An additional $72 million will be spent on tripling production at Microchip’s Oregon facilities.

“Semiconductors are the key input in so many goods that are vital to our economy,” Lael Brainard, White House National Economic Council director, said as part of the announcement. She also commented that if there had been a healthy chipmaking industry in the U.S. prior to the COVID pandemic, we could have decreased our “reliance on global supply chains that led to price spikes and long wait lines for everything from autos to washing machines during the pandemic.”

Well, hindsight is 20/20, Lael!

Microchip Technology already planned to spend up to $800 million on boosting its chip production in Oregon.

Still, Microchip’s stock took a wee bit of a tumble yesterday, despite the news. However, all chip stocks have headed lower this week anyway as the market finds its footing for the new year.

In fact, this week, the PHLX Semiconductor Sector Index — which is composed of the 30 largest U.S. companies involved in the chipmaking industry — has dropped by more than 7.5%. Last year, the index saw gains of 65% — its best performance since 2009.

A New Record for Online Shopping

According to a new report from Adobe’s (NSDQ: ADBE) Analytics unit, online spending reached a new peak during the 2023 holiday shopping season.

On a year-over-year basis, online spending grew by 5% thanks to deep discounts and the convenience of buy now, pay later (BNPL) services such as Klarna and Affirm (NSDQ: AFRM). In fact, Americans used BNPL to spend $16.6 billion online, the report said.

Adobe also reported that we spent a collective $38 billion online during Cyber Week, the five days between Thanksgiving and Cyber Monday.

That accounted for about 20% of all money spent online from November 1 to December 31.

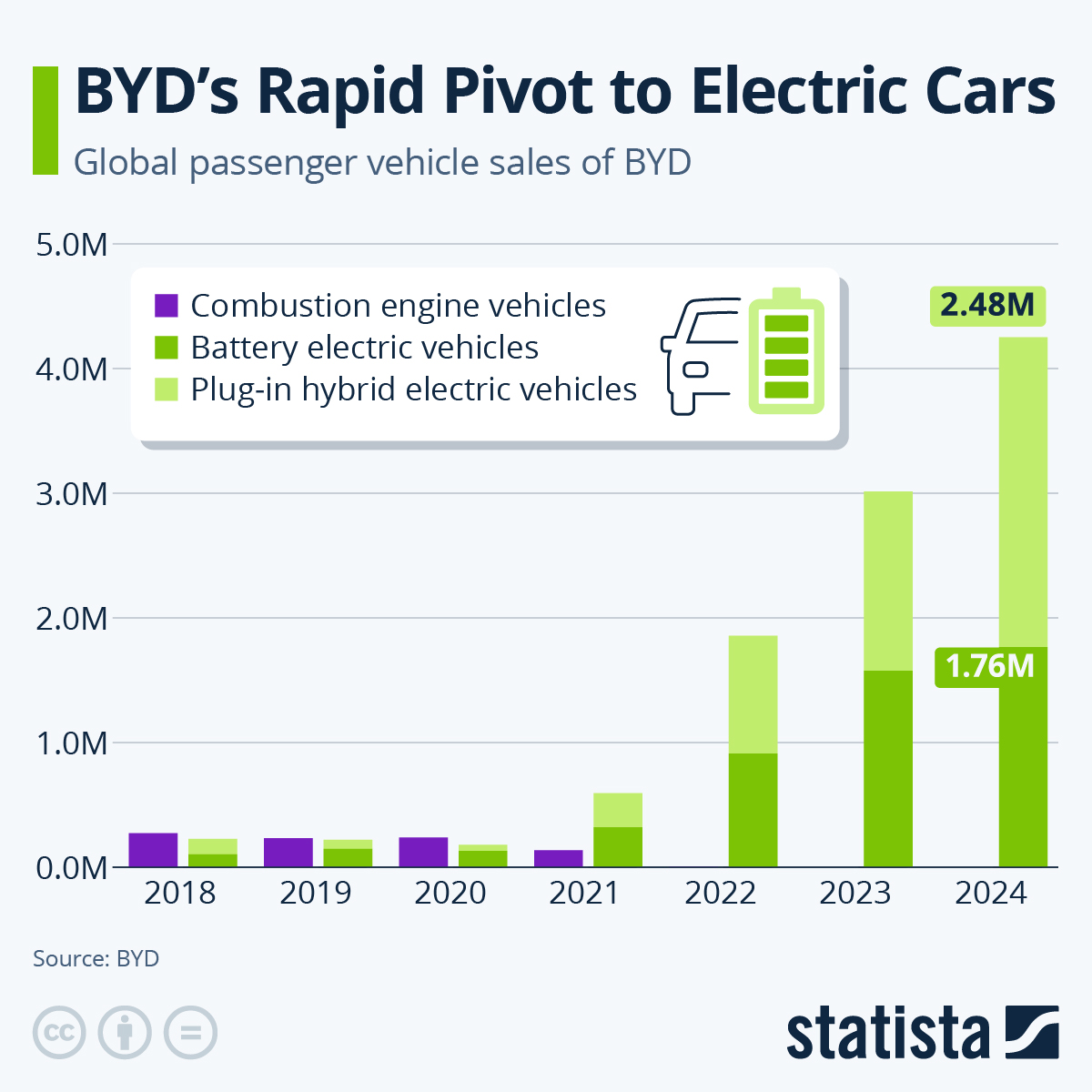

BYD’s Sprint to the Top

The other day I wrote about how Chinese automaker BYD (OTCMKTS: BYDDY) edged out Tesla (NSDQ: TSLA) to become the top producer of electric vehicles (EVs) during the fourth quarter of 2023.

Well, I just saw a chart that blew my mind.

Take a look at how rapid BYD’s ascent to the top has been:

You will find more infographics at Statista

You will find more infographics at Statista

Crazy, huh?

BYD went from producing fewer than 500,000 partially electric and internal combustion vehicles in 2018 to roughly 3 million “new energy” vehicles last year.

(New energy vehicles include battery-powered electrics and plug-in hybrids.)

In all, the Chinese automaker — which is backed by Warren Buffett’s Berkshire Hathaway (OTCMKTS: BYDDY) — has produced more than 6 million new energy vehicles in 15 years.

For 2024, the company intends to push past the 10 million vehicle milestone.

The Labor Market Is Getting Looser

According to the U.S. Labor Department, the number of job openings fell to the lowest level since March 2021 in November.

It’s all in the department’s Job Openings and Labor Turnover Survey (JOLTS) report, which showed that the number of new job listings for that month fell by 62,000, to 8.79 million.

That’s in line with the 8.8 million listings analysts had been expecting, according to Dow Jones.

In addition, the Labor Dept. reported that hiring activity fell by 363,000 jobs, while the number of layoffs dropped by 116,000.

There are now 1.4 open jobs for every available worker.

That’s still tight, but it’s a heckuva lot looser than the 2-to-1 ratio we saw as recently as 2022.

The Federal Reserve keeps its eye closely on the JOLTS report.

It’s among several regular data reports that members of the central bank’s Federal Open Market Committee (FOMC) consider when making decisions about monetary policy — you know, such as whether to raise or cut the Fed’s benchmark interest rate.

But although it looks like the Fed is close to reaching its much-ballyhooed “soft landing,” we shouldn’t get too excited about falling rates just yet.

According to Rob Temple, chief marketing strategist of Lazard, the “report is good news for American workers and the economy, but it also suggests to me that the Fed is unlikely to cut rates as aggressively in 2024, as markets currently indicate, given the risk of reigniting inflationary pressures.”

Why We’re Calling It Quits

Sorry, streaming services!

Fed up with rising prices and those seemingly eternal ad breaks (I hate you, LiMu the Emu and Doug), a record number of consumers in the U.S. are canceling their streaming subscriptions with Netflix (NSDQ: NFLX), Disney (NYSE: DIS), Apple (NSDQ: APPL), and other media companies.

According to a report from analytics company Antenna, as of November 2023, 24% of U.S. consumers canceled at least three streaming subscriptions in the last two years.

That’s a sizable increase from the 15% who canceled in November 2021.

The streaming services seem to think we want lavishly produced new content and are spending billions of dollars on it — rather than letting us watch stuff that actually bears merit. (What do you need in life other than Seinfeld and Miami Vice reruns?)

To pay for all of these new shows, companies are upping subscription prices or adding advertisements to existing price tiers where there weren’t any before.

As we all know, inflation has taken a toll on our budgets. Finally, a lot of us are getting fed up with being nickeled and dimed and are calling it quits.

After all, the complaints I’ve head about these streaming services sure sound a lot like the complaints we had back when we “cut the cord” on cable TV…

Of course, we’ll see how resolved we are on this issue when the next season of Stranger Things comes out. Then I bet a lot of us will re-up that Netflix subscription.

P.S. One of the easiest ways to become wealthy in the stock market is finding stocks that pay consistent dividends — and having the patience to let them grow your wealth over time.

That’s why our team has built a solid portfolio full of market-beating yields that reward investors year after year. With a little patience (and dividend reinvestment), you could be on your way to earning tens of thousands in dividends a year.