The PPI, Microsoft’s Top Spot, and Elon Musk’s New Demands

Editor’s Note: Well, it’s cold and snowy here in the Mid-Atlantic. Which means I’m looking up Miami temperatures on the weather app.

Oh well. Let’s get to it!

Feeling Down? Check Out the PPI

Last week, the U.S. Labor Department reported a worse-than-expected Consumer Price Index (CPI) reading. According to the report, inflation ticked slightly higher last month, by 0.3% from November and 3.4% on a year-over-year basis.

Because analysts had expected the CPI to show just a 3.2% year-over-year gain, the news bummed out the markets — and those of us who watch them.

However, if you want a piece of optimistic news about prices, dig this: The Producer Price Index (PPI) unexpectedly fell last month.

The PPI is the Labor Department’s measure of prices on a wholesale level. Because it tends to reflect prices “upstream” from consumers, it can be a good indication of where the CPI is eventually headed.

According to the Labor Department, the PPI dropped by 0.1% from November to December. Economists had been expecting a monthly increase of 0.1%.

In addition, stripping out volatile food and energy prices, the core PPI remained flat in December. Economists had expected a 0.2% increase.

And let’s not omit the PPI’s measure of final demand minus food, energy, and trade services (what a mouthful!). On a year-over-year basis, this index increased 2.5% for all of 2023. That compares favorably with the 4.7% increase reported for 2022.

And final demand prices for food and energy look encouraging, too, falling by 0.9% and 1.2%, respectively. Final demand prices for services stayed flat for the third straight month.

“What inflation risks remain in the U.S. economy clearly cannot be sourced to any upward pressure in producers’ costs,” Kurt Rankin, senior economist at PNC Financial (NYSE: PNC), said.

“Whether surveying from producers’ intermediate or final demand perspective, there is little to no pricing pressure headed into the U.S. economy from the supply side entering 2024.”

Yay!

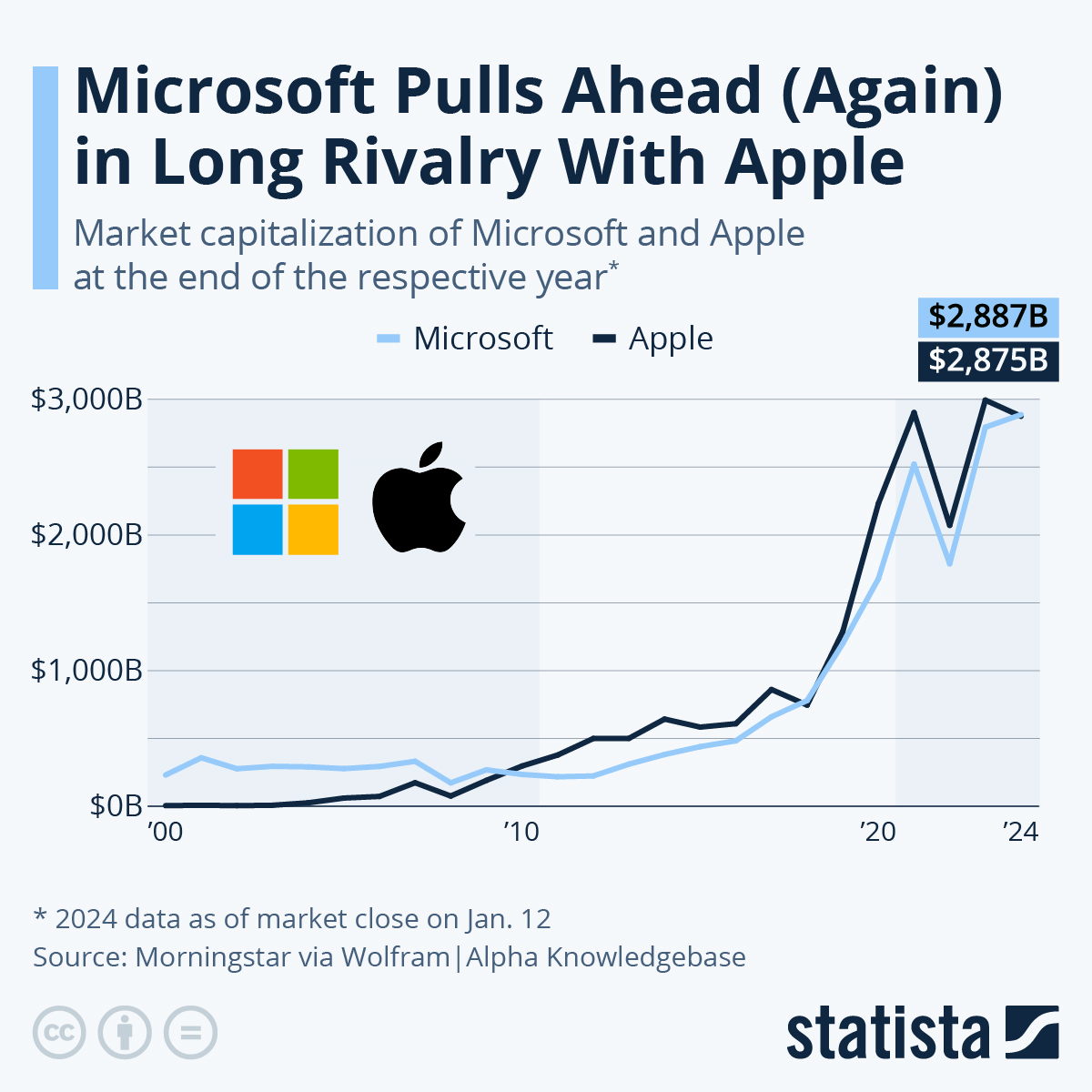

Microsoft Is Neck and Neck With Apple

For the last two weeks, Microsoft (NSDQ: MSFT) has been seriously challenging Apple’s (NSDQ: AAPL) position as the most valuable publicly traded company in the world by market cap.

And currently, the Bill Gates-founded company is winning. Both companies sport market caps close to $3 trillion — Microsoft’s valuation is currently just north of $2.9 trillion, while Apple is hovering around $2.84 trillion.

This latest runup marks the first time since 2021 that Microsoft has taken the top spot.

Microsoft’s stock has certainly been helped out by the fact that Apple has had a rough start to 2024. The Cupertino Giant has faced several setbacks in recent weeks, including concerns of weakening demand for iPhones in China, an unexpected year-over-year revenue decline at Foxconn — the company’s iPhone assembler — and a new potential antitrust lawsuit courtesy of the U.S. Department of Justice.

On the other hand, Microsoft has been doing just fine, thanks largely to its leading position in artificial intelligence (AI) and cloud-computing technology.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

No matter who wins the current tug-of-war, it’s becoming increasingly likely that one — or both — of these companies may cross the $3 trillion mark for the first time ever this year.

Gov’t to Airlines: No Merger for You!

The U.S. Justice Department has effectively put the kibosh on JetBlue Airways’ (NSDQ: JBLU) planned acquisition of Spirit Airlines (NYSE: SAVE).

Surprise, surprise.

The Biden administration hasn’t been fooling when it has taken an anti-M&A stance.

Now a federal judge has blocked the purchase, agreeing with the Justice Department that the merger would drive up budget fares and hurt competition.

In July 2022, JetBlue devised its plan to purchase Spirit after winning a bidding war with Frontier Group (NSDQ: ULCC). The deal was valued at $3.8 billion.

If it had gone through, it would have made the combined airline — which would carry the JetBlue moniker — the U.S.’s fifth-largest carrier, behind United Airlines (NSDQ: UAL), Delta Air Lines (NYSE: DAL), American Airlines (NSDQ: AAL), and Southwest Airlines (NYSE: LUV).

“JetBlue plans to convert Spirit’s planes to the JetBlue layout and charge JetBlue’s higher average fares to its customers,” the U.S. District Court judge wrote in his decision. “The elimination of Spirit would harm cost-conscious travelers who rely on Spirit’s low fares.”

Currently, the “Big Four” airlines control nearly 80% of the domestic air travel market.

However, JetBlue and Spirit have gamely announced they’re still going to try to get a deal go through.

“We continue to believe that our combination is the best opportunity to increase much-needed competition and choice by bringing low fares and great service to more customers in more markets while enhancing our ability to compete with the dominant U.S. carriers,” a joint statement from the two airlines said.

“We are reviewing the court’s decision and are evaluating our next steps as part of the legal process.”

Musk Wants More

Oh, that silly old Elon Musk!

His latest shenanigans: Demanding a larger compensation package from Tesla (NSDQ: TSLA), the company he’s supposed to be CEO-ing when he isn’t buying social media companies for too much money.

In a series of posts on X, the world’s richest man complained that he wants a bigger payday from Tesla that would amount to 25% of the company’s stock. Currently, he owns about 12% of the electric vehicle (EV) maker.

You see, Musk apparently has big plans for Tesla — which don’t involve EVs. He believes the company’s “real” future lies in AI and robotics. And he’s concerned that by not having a big enough position in the company, other shareholders — such as institutional investors — can nix his ideas.

“I am uncomfortable growing Tesla to be a leader in AI and robots without having ~25% voting control,” Musk wrote. “Enough to be influential, but not so much that I can’t be overturned. Unless that is the case, I would prefer to build products outside of Tesla.”

Of course, Musk owned more than 20% of Tesla. But he sold off a big chunk of that to buy Twitter for an ill-advised $44 billion.

P.S. One of the easiest ways to become wealthy in the stock market is finding stocks that pay consistent dividends — and having the patience to let them grow your wealth over time.

That’s why our team has built a solid portfolio full of market-beating yields that reward investors year after year. With a little patience (and dividend reinvestment), you could be on your way to earning tens of thousands in dividends a year.