A Netflix Beat, Microsoft at $3 Trillion, and 40 Years of Mac

Editor’s Note: Friday is here, and today’s temperatures are so warm you’d think spring had sprung.

While driving to the grocery store this morning, I saw people wearing shorts and flip-flops. I love optimists!

Netflix’s Fourth-Quarter Beat

Shares of Netflix (NSDQ: NFLX) have been on the rise this week thanks to a fourth-quarter earnings report that showed stronger-than-expected subscriber growth.

According to Netflix, the streaming service added 13.1 million subscribers at the end of 2023. That brings the total of paid members to a new record of 260.8 million.

The report was welcome news for Netflix bulls, who were disappointed by the company’s performance in 2023. In the first half of the year, the company lost subscribers for the first time in its history.

However, in the third quarter, Netflix’s fortunes began to improve as the company reported a gain of 8.76 million subscribers.

Anyway, Netflix also reported net income of $937.8 million, or $2.11 per share, for the fourth quarter. That was a big improvement over the $55.3 million, or 12 cents per share, reported in the fourth quarter of 2022.

Netflix also reported quarterly revenue of $8.83 billion — a big year-over-year increase from $7.85 billion. Revenue also beat Wall Street’s expectations of $8.72 billion.

It’s impossible to read about the state of the streaming industry these days without being reminded that it’s a fiercely competitive field. That certainly remains true.

However, unlike many of its rivals — here’s looking at you, Walt Disney (NYSE: DIS) — Netflix has actually been able to profit from its streaming service.

In a statement this week, Netflix reaffirmed its commitment to expansion through content creation — rather than M&A (merger and acquisition) activity like so many of its rivals.

“As our competitors adjust to these changes, it’s logical to expect further consolidation, particularly among companies with large and declining linear networks,” a statement from Netflix said this week.

“We’re not interested in acquiring linear assets. Nor do we believe that further M&A among traditional entertainment companies will materially change the competitive environment, given all the consolidation that has already happened over the last decade.”

Bad to Worse for Boeing

Once upon a time, Boeing (NSDQ: BA) was a company the U.S. took pride in.

However, in recent years, quality issues have tarnished the company’s once-sterling reputation.

By now you’ve certainly heard about the company’s 737 Max 9 crisis. A few weeks ago, a panel fell off the side of a Max 9 cabin during an Alaska Air (NYSE: ALK) flight.

I can’t imagine how scary that must have been for passengers.

The incident led the U.S. Federal Aviation Authority (FAA) to temporarily ground most of the Max 9 jets in use for inspection and repair.

And according to United Airlines (NSDQ: UAL), Boeing’s largest Max 9 customer, all of this trouble has made it rethink its order of 737 Mac 10 jets.

Not yet approved by the FAA, the Max 10 is the anticipated larger version of the Max 9. And now it looks likely that the model’s debut will be delayed.

According to United CEO Scott Kirby, the “best case” is a five-year delay for Max 10 planes.

“I think the Max 9 grounding is probably the straw that broke the camel’s back for us,” Kirby said in an interview on Tuesday. “We’re going to at least build a plan that doesn’t have the Max 10 in it.”

United ordered 100 Max 10 planes in 2018. The carrier already owns nearly 80 737 Max 9 aircraft.

And due to the grounding order, United has estimated an operating loss in the first quarter.

Microsoft at $3 Trillion

Microsoft (NSDQ: MSFT) reached the $3 trillion mark this week for the first time ever. The tech giant is the second company ever to reach that massive valuation — Apple (NSDQ: AAPL) became the first member of the $3 trillion club last June.

Microsoft shares have been on a steady incline since the start of last year. The buzz about the potential of artificial intelligence (AI) technology — coupled with Microsoft’s hefty investments in OpenAI, the creator of the uber-popular ChatGPT chatbot — has helped the stock overcome its 2022 slump.

As a result, Microsoft shares have soared by nearly 70% in the last 12 months.

Both Microsoft and Apple are members of the “Magnificent Seven,” tech stocks with market caps larger than the gross domestic products (GDPs) of many countries.

Along with Microsoft and Apple, the list includes chipmaker Nvidia (NSDQ: NVDA), e-commerce giant Amazon (NSDQ: AMZN), Google parent Alphabet (NSDQ: GOOGL), social media powerhouse Meta Platforms (NSDQ: META), and electric vehicle (EV) company Tesla (NSDQ: TSLA).

Together, the Magnificent Seven accounted for roughly 28% of the S&P 500 at 2023’s year-end, according to S&P Dow Jones Indices.

However, currently, Microsoft itself accounts for more than 7% of the S&P 500.

And Microsoft and Nvidia together are responsible for about three-quarters of the gains in the index so far this year.

Despite this, analysts think Microsoft still has plenty of room for growth.

Analysts at both Bank of America (NYSE: BAC) and Morgan Stanley (NYSE: MS) have upped their price targets on the stock to $450 per share. (Microsoft currently trades around $405 per share.)

However, Citigroup (NYSE: C) analysts raised their price target from $432 per share to a whopping $470 per share this week.

“We expect a solid [earnings] beat and raise and believe improving IT budgets, partially driven by [generative AI] where MSFT is in a leadership position [with] multiple monetization vectors can drive a durable multiyear reacceleration in top/bottom line growth,” the analysts wrote in a note.

Mac at 40

Forty years ago this week, on January 24, 1984, Apple debuted the first Macintosh computer.

From the start, the Mac was a real game-changer. It was the first mass-market personal computer that was ready to go out of the box with a graphical user interface and a mouse.

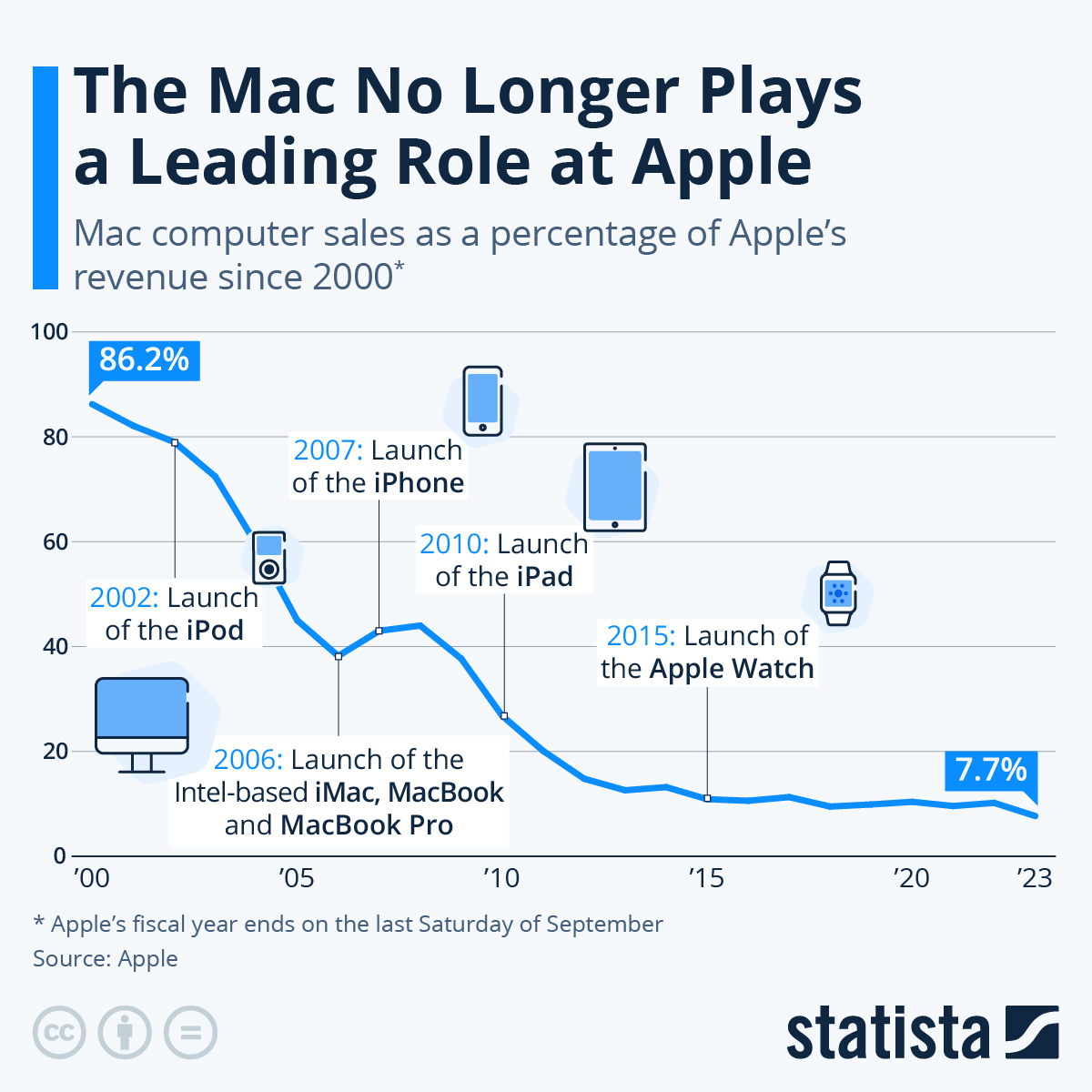

However, in recent years, Macs have taken a back seat to Apple’s other releases, such as the iPod, iPad, and iPhone.

In 2000, Apple derived 86.2% of its total revenue from personal computer sales. But by last year, that percentage had dwindled to 7.7%.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

P.S. If you’re looking for promising profit-making opportunities, consider the work of my colleague, Nathan Slaughter, the chief investment strategist of High-Yield Investing.

For the last 16 years, Nathan has made it his solitary focus to help everyday Americans invest profitably for retirement.

As a high-yield expert, Nathan has devised a simple strategy that could help you generate a steady stream of cash, almost like clockwork. Click here for details.