Eli Lilly’s Q4, Boeing’s Quality Control Issues, and More!

Editor’s Note: I saw my neighborhood’s first sign of spring: a cluster of blooming purple crocuses. That’s it; I’m putting away my socks until fall… not that I can find them anyway.

Eli Lilly Beats Wall Street for Q4

Eli Lilly (NYSE: LLY) reported strong fourth-quarter earnings results that soundly trounced Wall Street expectations.

The company reported earnings per share of $2.49 — versus analyst expectations of $2.22 per share.

In addition, revenue for the fourth quarter came in at $9.35 billion — a 28% year-over-year increase. Wall Street had estimated revenue of “only” $8.93 billion.

The U.S.-based drugmaker also reported net income of $2.19 billion, of $2.42 per share. In the year-ago quarter, Eli Lilly saw net income of $1.94 billion, or $2.14 per share.

For the full year, Eli Lilly is expecting adjusted earnings in a range of between $12.20 and $12.70 per share. The company also expects full-year revenue to be between $40.4 billion and $41.6 billion.

That’s in line with Wall Street expectations of adjusted earnings of $12.43 per share and revenue of $39.98 billion.

For the Wall Street-beating fourth quarter, Eli Lilly can thank its hormone-targeting incretin drugs, Zepbound (for weight loss) and Mounjaro (for diabetes).

During the quarter, Eli Lilly raked in $175.8 million just from Zepbound sales alone. The Federal Drug Administration (FDA) approved the use of Zepbound only in early November.

Some analysts believe Zepbound could generate more than a billion dollars in sales during its first year on the market. And a few have even written that the weight-loss drug could become the biggest pharma seller of all time.

Hertz Blames EVs for Disappointing Quarter

Meanwhile, rental car company Hertz (NSDQ: HTZ) reported an earnings miss for the fourth quarter.

The car rental giant reported an adjusted loss per share of $1.36, versus Wall Street’s expectations of a $1.05 per share loss.

Hertz also reported a net loss of $348 million for the quarter. That’s a significant drop from the $116 million in net income it reported for the year-ago quarter.

According to Hertz, the problem lies in the company’s electric vehicle (EV) fleet.

“We continued to face headwinds related to our electric vehicle fleet and other costs,” CEO Stephen Scherr said.

Last month, Hertz announced that it would sell the roughly 20,000 EVs in its Tesla (NSDQ: TSLA) fleet due to high maintenance costs and low resale values.

This week, Hertz went a step further by announcing that it would pause its purchase of 65,000 EVs from Tesla rival Polestar (NSDQ: PSNYW).

Hertz inked the deal with Polestar for $3 billion back in 2022. At the time, the purchase was viewed as a major coup for the EV industry.

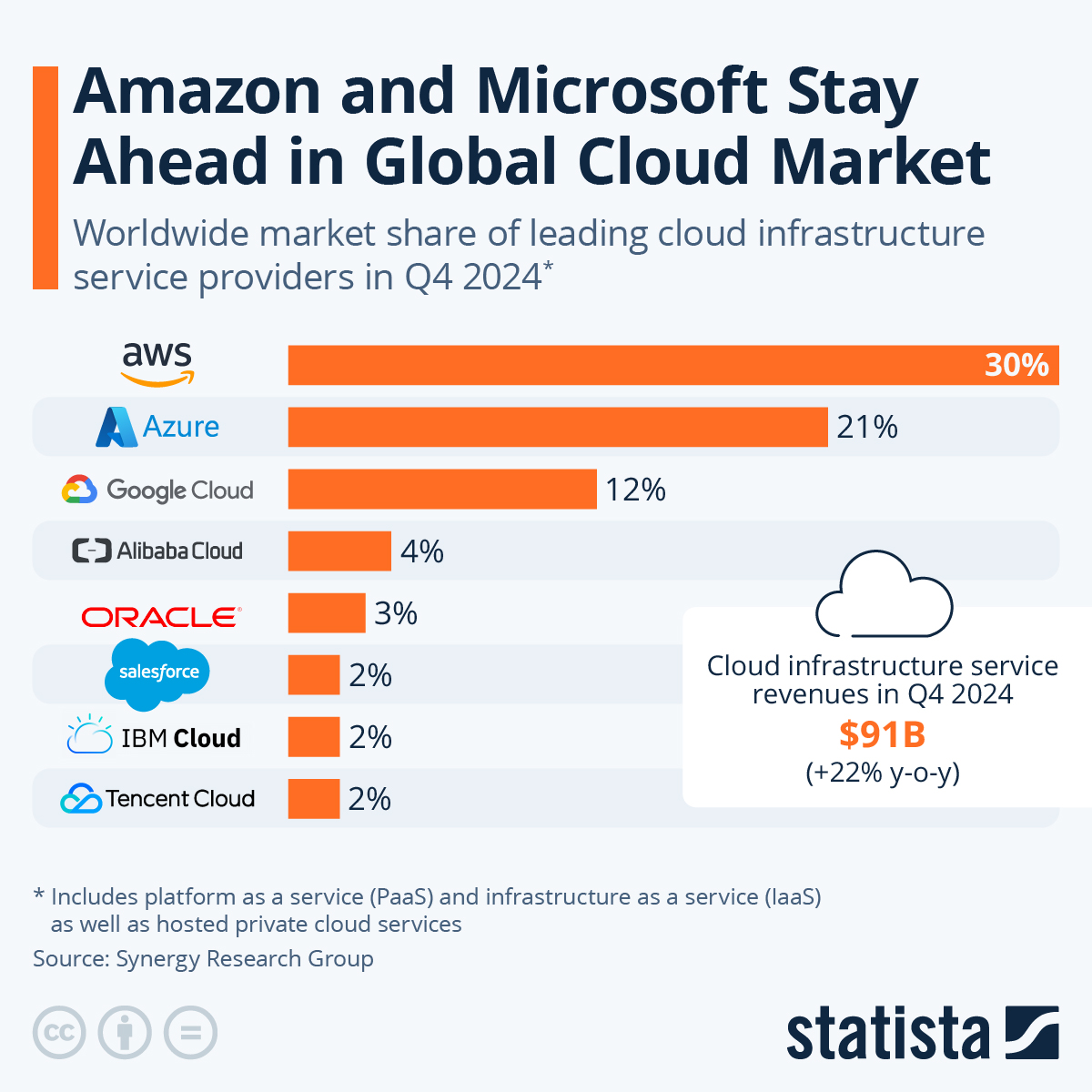

Amazon Still Controls the Cloud?

According to a recent report from Synergy Research, Amazon (NSDQ: AMZN) reigns supreme when it comes to cloud computing.

The e-commerce giant’s cloud unit, Amazon Web Services (AWS) controlled 31% of the cloud market in the fourth quarter of 2023.

However, it’s starting to slowly give way to Microsoft (NSDQ: MSFT).

In the fourth quarter of 2022, AWS controlled 33% of the cloud market.

Microsoft Azure’s share has now grown to 24%.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

Alphabet’s (NSDQ: GOOGL) Google Cloud came in at third place, with 11% of the market share.

By comparison, the other players in this field don’t stand much of a chance. They’re stuck in the single digits.

More Problems for Boeing

Boeing (NYSE: BA) has a new issue involving its 737 Max jets.

Over the weekend, Stan Deal, the Seattle-based company’s head of commercial aircraft, sent out a memo to employees.

As it turns out, someone over at Spirit AeroSystems (NYSE: SPR) — Boeing’s 737 Max fuselage supplier — alerted Deal to the concern that two holes may not have been drilled according to Boeing’s specifications.

As a result, Boeing will have to correct the issue on several dozen undelivered jets.

“While this potential condition is not an immediate flight safety issue and all 737s can continue operating safely, we currently believe we will have to perform rework on about 50 undelivered airplanes,” the memo said.

“A member of our team identified an issue that does not conform to engineering standards,” Spirit AeroSystems spokesperson Joe Buccino said. “Once notified, we began immediate actions to identify and implement appropriate repair solutions. We are in close communication with Boeing on this matter.”

The litany of 737 Max problems keeps growing.

About a month ago, a panel fell off a Boeing 737 Max 9 plane on an Alaska Air (NYSE: ALK) due to an improperly installed door plug.

But that wasn’t the first 737 Max quality crisis. Two deadly accidents in 2018 and 2019 led to the grounding of the model.

According to Deal’s memo, at a recent Boeing staff meeting, “Many employees voiced frustration with… how unfinished jobs — either from our suppliers or within our factories — can ripple through the production line.”

He added, “These employees are absolutely right. We need to perform jobs at their assigned position. We have to maintain this discipline within our four walls, and we are going to hold our suppliers to the same standard.

“We recently instructed a major supplier to hold shipments until all jobs have been completed to specification. While this delay in shipment will affect our production schedule, it will improve overall quality and stability.”

Boeing has declined to issue a forecast for 2024, thanks to these quality control issues. “While we often use this time of year to share or update our financial and operational objectives, now is not the time for that,” Boeing CEO David Calhoun said last week.

“We will simply focus on every next airplane while doing everything possible to support our customers, follow the lead of our regulator, and ensure the highest standard of safety and quality in all that we do.”

P.S. If you’re looking for promising profit-making opportunities, consider the work of my colleague, Nathan Slaughter, the chief investment strategist of High-Yield Investing.

For the last 16 years, Nathan has made it his solitary focus to help everyday Americans invest profitably for retirement.

As a high-yield expert, Nathan has devised a simple strategy that could help you generate a steady stream of cash, almost like clockwork. Click here for details.