Retail Sales, Walmart’s Q4, and Big Tech Profits

Editor’s Note: Like many American consumers, I’ve found myself being more careful with my spending lately. High prices — especially for food — are starting to weigh on my budget.

And to be honest, I’ve found that discretionary splurge purchases are a lot less fun than they used to be.

Retail Sales Fall More Sharply Than Expected

Last week, the Commerce Department announced that consumer spending fell more sharply than expected in January.

According to the department’s Census Bureau, advance retail sales fell by 0.8% last month. What’s more, the bureau revised December’s retail sales downward, from 0.6% to 0.4%. (For what it’s worth, economists had originally expected a 0.4% gain for December, according to Reuters.)

Economists had also expected a decline for January, but not by that much. According to Dow Jones, the experts had been expecting January sales to fall by just 0.3%.

Even stripping out auto sales — which have been hampered by rising interest rates on top of record-high prices — sales still fell by 0.6%. Analysts had been expecting a 0.2% gain here.

On a year-over-year basis, sales rose by only 0.6%.

Because the Census Bureau’s sales report isn’t adjusted for inflation, the report indicated that consumer spending trailed January’s 0.3% headline inflation growth, as measured by the Consumer Price Index (CPI).

The Labor Department reported last week that core CPI — minus volatile food and energy costs — rose 0.4% last month.

In January, headline and core CPI rose by 3.1% and 3.9%, respectively, year over year.

The consumer spending report showed that sales at stores selling building materials and garden supplies — think Home Depot (NYSE: HD) — were particularly slow, declining by 4.1%. Car dealerships and auto parts store sales fell by 1.7%, while sales at gas stations also dropped by 1.7% (thanks largely to falling pump prices). “Miscellaneous” store sales took a 3% nosedive last month.

However, sales at restaurants and bars rose by 0.7%. Apparently, folks are still taking “Eat, drink, and be merry” to heart.

Economists were quick to allay fears after the report’s release.

“It’s a weak report, but not a fundamental shift in consumer spending,” the Navy Federal Credit Union’s Robert Frick said. “December was high due to holiday shopping, and January saw drops in those spending categories, plus frigid weather plus an unfavorable seasonal adjustment.

“Consumer spending likely won’t be great this year, but with real wage gains and increasing employment it should be plenty to help keep the economy expanding.”

Indeed, the Labor Department reported on Thursday that the jobs market remains relatively resilient. Initial claims for unemployment insurance amounted to 212,000 during the week ended February 10. That’s a drop of 8,000 from the previous week and less than what analysts had expected (220,000).

Of course, everyone has been nervously eyeing these reports with a thought toward the Federal Reserve and when the central bank will start cutting rates.

Remarks made by several Fed heads indicate that no more rate hikes are in the works… but it’s looking pretty certain that the first cuts won’t happen until June. Currently, the futures market is pricing in the four rate cuts in 2024 that should shave a cumulative percentage point off the Fed’s current benchmark rate.

Walmart’s Better-Than-Expected Holiday Quarter

This week, Walmart (NYSE: WMT) reported holiday-quarter earnings that beat Wall Street’s expectations.

The largest retailer in the world reported that quarterly earnings per share (EPS) reached $1.80, versus the $1.65 per share analysts had been expecting. And revenue came in at $173.39 billion. Wall Street had forecast revenue of $170.71 billion. That’s about a 6% improvement from the $164.05 billion in revenue reported for the year-ago quarter.

However, Walmart’s net income dropped from $6.28 billion, or $2.32 per share, in the year-ago period to $5.49 billion, or $2.03 per share.

According to the company’s chief financial officer, John David Rainey, customers are still watchful of their spending, being less likely to buy big-ticket items such as TVs and computers.

Walmart announced that it’s expecting consolidated net sales to increase by 4% to 5% in the current quarter. The company is also expecting adjusted EPS of $1.48 to $1.56, pre-stock split.

And for its current full fiscal year, Walmart is also expecting consolidated net sales to rise by 3% to 4% with adjusted EPS of $6.70 to $7.12.

According to the company, its e-commerce sales rose in the double digits during the fourth quarter. Walmart reported global online growth of 23% on a year-over-year basis, to more than $100 billion. In the U.S. alone, Walmart’s e-commerce sales grew by 17%.

In addition, the company noted that revenue from advertising had grown by roughly 33% globally and 22% here in the U.S. on a year-over-year basis.

Walmart’s ad revenue will no doubt be boosted by the company’s recently announced purchase of Vizio (NYSE: VZIO), a company that makes smart TVs. The mega-retailer announced that it will acquire Vizio in a cash deal worth $2.3 billion, or $11.50 per share.

Both Walmart and its sister warehouse chain, Sam’s Club, have been major retailers for Vizio’s products. Vizio offers its own SmartCast Operating System, which allows users to watch ad-supported content for free.

According to Walmart, SmartCast currently has around 18 million active users.

“We believe Vizio’s customer-centric operating system provides great viewing experiences at attractive price points,” Walmart’s executive vice president and chief revenue officer, Seth Dallaire, said in a statement. “We also believe it enables a profitable advertising business that is rapidly scaling.”

Walmart — which is also the U.S.’s largest grocer — has managed to remain relatively healthy while other retailers suffer from high inflation. The company’s low prices have attracted better-heeled shoppers than usual, too.

That allowed Walmart to pursue a plan of expanding its store reach and updating its existing stores while other retailers have looked to drastically cut costs.

Thousands per Second…

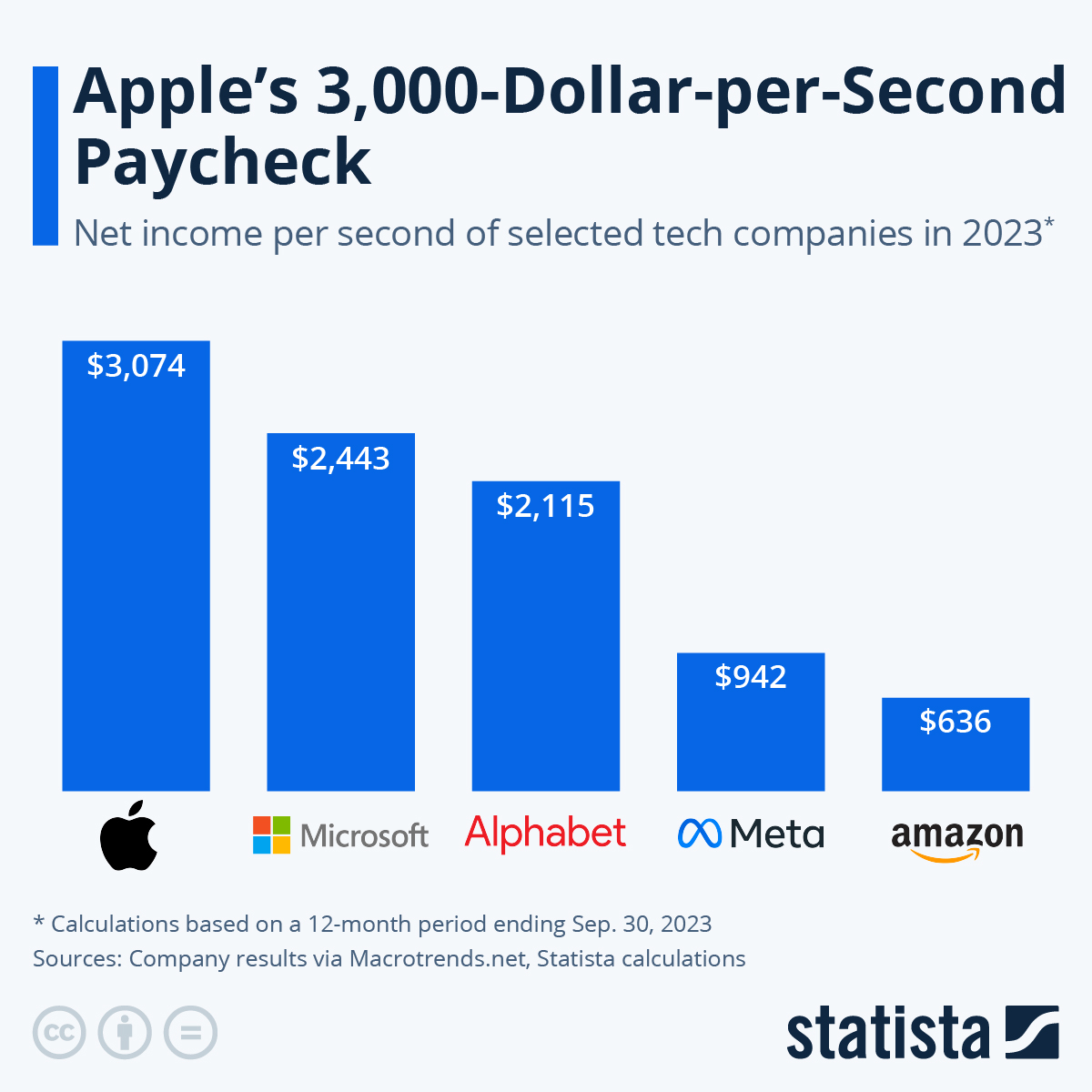

How much money do some of the hottest tech players make per second?

Statista’s analysts looked at profits per second for the GAMAM group, which includes Google parent Alphabet (NSDQ: GOOGL), Apple (NSDQ: AAPL), Microsoft (NSDQ: MSFT), Amazon (NSDQ: AMZN), and Meta Platforms (NSDQ: META) — the company formerly known as Facebook.

They found that Apple earned the most net income per second in 2023 — a whopping $3,074. That was followed by Microsoft, at $2,443, and Alphabet, at $2,115. Meanwhile, Meta made a profit of $942 per second last year, while Amazon hauled in $636 per second.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

Last year, the U.S. median household income was roughly $75,000 — meaning Apple made a year’s worth of dough in less than 30 seconds.

Coinbase Crushed It in Q4

Shares of Coinbase (NSDQ: COIN) soared last week after the company reported its first quarterly profit since the fourth quarter of 2021.

According to the company — which runs the largest cryptocurrency trading platform in the U.S. — its fourth-quarter net income totaled $273 million. Coinbase closed out 2023 with a full-year net profit of $95 million.

Net revenue rose by nearly 50% on a year-over-year basis, from $605 million to $905 million. And total transaction revenue rose by 64%, to $529 million. According to the company, transaction costs were a big driver for its fourth-quarter revenue. Revenue from subscriptions and services stayed flat during the quarter.

Coinbase also reported that its consumer trading revenue for the quarter reached $493 million. That’s a 79% improvement from the third quarter of 2023.

In the fourth quarter, Coinbase was certainly helped out by signs that the U.S. Securities and Exchange Commission (SEC) would approve the first spot Bitcoin (BTC) exchange-traded funds (ETFs).

These ETFs, which were approved last month, allow investors to gain exposure to the world’s largest crypto without actually owning it. They also opened the realm of crypto up to many institutional investors as well.

Coinbase just so happens to serve as custodian for eight of the 11 Bitcoin ETFs that the SEC approved in January. So it’s no wonder that the platform has experienced a flurry of activity in recent months.

Still, this year could be a volatile one for Coinbase. The company is still facing a lawsuit from the SEC that accuses the company of operating an unlicensed securities exchange.

Coinbase CEO Brian Armstrong reiterated on a call with analysts Thursday that he’s prepared to fight and that he plans to continue to press Congress for clarity on crypto regulation.

“We remain confident the U.S. will get this right, whether it comes from the courts creating new case law, Congress passing new legislation, or ultimately the 52 million Americans who’ve used crypto voting in this upcoming election,” Armstrong said.

He added that he’s still waiting for cryptocurrency to have an “iPhone moment,” referencing Apple’s (NSDQ: AAPL) watershed.

“We’re hoping we can make that happen.”

P.S. Cryptocurrency represents a lasting revolution in finance, investing, and consumer behavior.

Consider this: Bitcoin (BTC), the leading “blue chip” cryptocurrency, gained a whopping 156% in price in 2023.

This bullishness has extended throughout the crypto segment and the momentum is likely to continue throughout 2024.

Every portfolio should have some sort of exposure to crypto. But you need to be informed to make the right choices. Start receiving our FREE e-letter, Crypto Investing Daily. Click here now!