Optimistic GDP Forecasts, Macy’s Store Closure Plans, and Grassroots Crypto

Editor’s Note: Happy Wednesday, dear reader! I hope you are enjoying the final week of February. Hopefully, we’ll start seeing early signs of spring before too long.

This would definitely be me:

Now let’s get to it!

NABE Boosts U.S. GDP Forecast for 2024

Last year, recession worries ran high. But the economy kept growing. And for 2024, a panel of National Association for Business Economics (NABE) economists is predicting that the economy will continue to grow some more.

According to the report, the U.S. gross domestic product (GDP) is expected to grow by 2.2%.

That’s higher than the group’s earlier forecast. Back in November, NABE reported GDP should rise by only 1.3% this year.

NABE is also expecting the U.S. unemployment rate to increase this year — but only to 4%. Currently, the unemployment rate is hovering around 3.7%.

This optimism is due largely to expectations of slowing inflation. NABE has forecast that the Consumer Price Index (CPI) — which measures prices for a basket of consumer goods and services — will slow to an annual rate of 2.4% in 2024.

Last year, the CPI recorded annual growth of 4.1% — and 8% in the year before that.

Although prices are still expected to rise, the slower pace at which they increase should lead the Federal Reserve to start trimming its benchmark interest rate. NABE is expecting this to happen sometime between April and June.

Macy’s Announces an Overhaul

Macy’s (NYSE: M) announced this week that it plans to revamp itself to appeal more to today’s modern shoppers.

The troubled department store chain intends to do this by focusing on smaller, more luxury-focused stores.

As part of the overhaul, Macy’s said it will shutter 150 underperforming stores by 2026. The company announced that 50 of these will close by the end of the current year.

By 2026, the company plans to operate only 350 Macy’s stores.

Macy’s said it will also shift its focus to its Bloomingdale’s and Bluemercury stores, which have seen better sales than its namesake brand in recent years. The company intends to open more of these stores, which specialize in premium merchandise and attract a better-heeled clientele than Macy’s department stores.

As for Macy’s branded stores, the company plans to open 30 smaller department stores in the next two years.

However, the retailer announced that these new stores will not be located in enclosed shopping malls, which have seen shrinking foot traffic thanks to both the rise of e-commerce giants like Amazon (NSDQ: AMZN) and the COVID-19 pandemic.

Since 2015, Macy’s has closed roughly 300 stores — while its share price has shed approximately 75% of its value.

In January, the retailer announced that it would downsize by laying off 2,350 workers.

The company has also come under fire from activist investors. That has included a hostile takeover bid by Arkhouse Management Co. for $6 billion last month.

And last week, Arkhouse nominated nine directors to Macy’s 14-member board.

“The board’s history of poor performance and continued refusal to engage constructively with our credible and motivated buyer group have led us to the decision to nominate a slate of highly qualified, independent directors to reconstitute Macy’s board,” a statement from the activist investor group said.

In a response, Macy’s said that it will consider the nominations. But the retailer was clearly not pleased with the takeover attempt.

“Arkhouse [has] yet to provide any financing details that would enhance the actionability of their proposal despite multiple opportunities to do so, and instead of attempting a constructive dialogue, Arkhouse has chosen to launch a proxy contest,” a company statement said.

Macy’s announcement that it will reinvent itself is clearly an attempt to keep the activist investor barbarians from the gate.

Grassroots Crypto Use on the Rise

Along with prices and weight-loss drugs, the use of cryptocurrencies is also on the rise.

According to a report from blockchain data firm Chainalysis, “grassroots” adoption of crypto — that is, use by “average, everyday people” is growing in many quarters of the world.

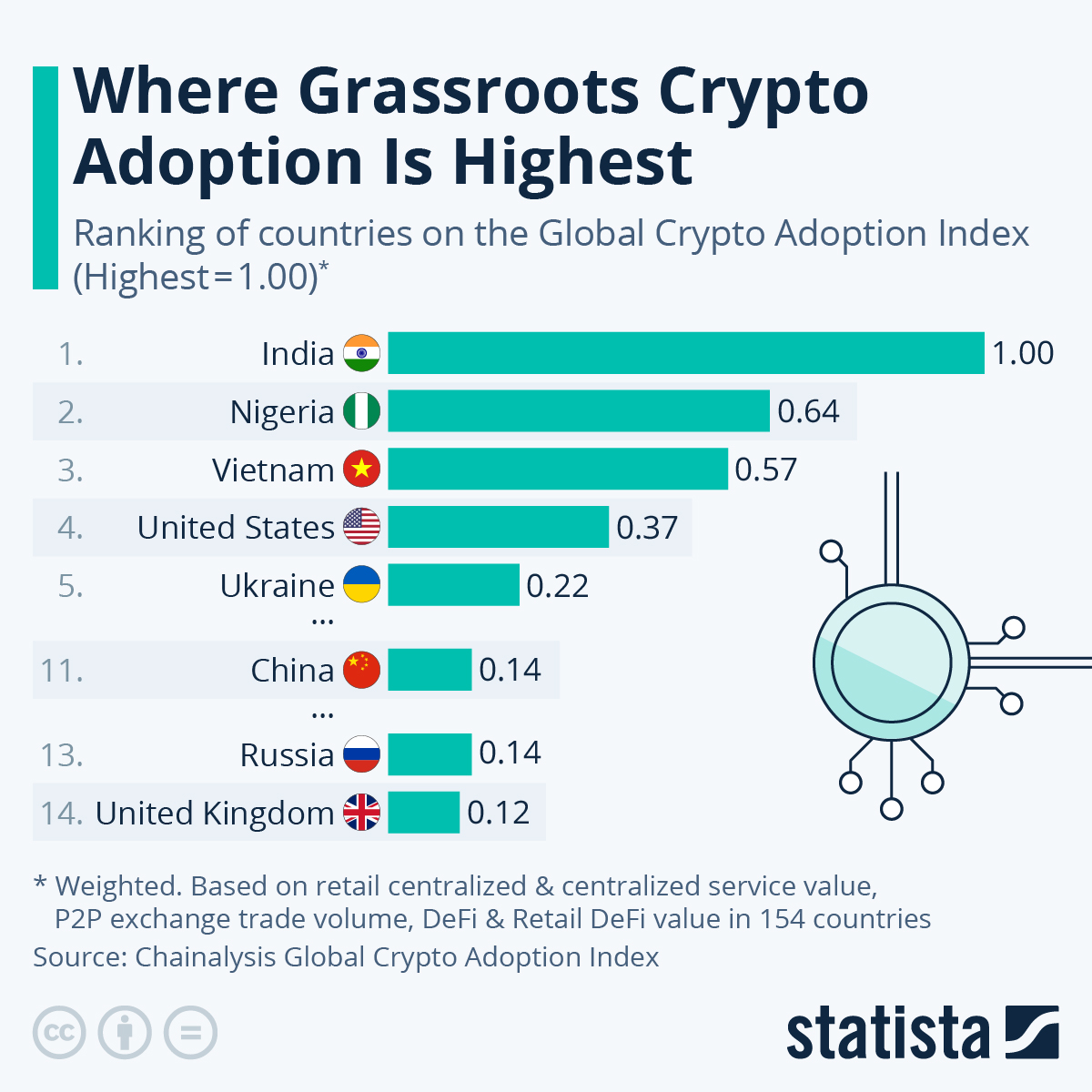

The firm’s Global Crypto Adoption Index rates countries based on the volume of peer-to-peer crypto transactions and trading on centralized platforms.

The most recent reading of the index shows that India is currently the country with the most grassroots adoption of digital currencies, followed by Nigeria and Vietnam.

This makes sense — these are developing countries, and sometimes it’s easier for residents to use crypto than a traditional bank.

However, the U.S. is currently in fourth place. It would seem that crypto is gaining some serious ground among consumers here too.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

Clearly, cryptocurrency represents a lasting revolution in finance, investing, and consumer behavior. Consider this: Bitcoin (BTC), the leading “blue chip” cryptocurrency, gained a whopping 156% in price in 2023.

This bullishness has extended throughout the crypto segment and the momentum is likely to continue throughout 2024.

Every portfolio should have some sort of exposure to crypto. But you need to be informed, to make the right choices.

Start receiving our FREE e-letter, Crypto Investing Daily. Click here now!