Apple’s $2B Fine, an Offer for Macy’s, and Energy Price Increases

Editor’s Note: It’s Wednesday again. That means it’s time for another roundup of news.

Let’s get to it!

The EU Fines Apple

This week, the European Commission — the European Union’s executive branch — slapped Apple (NSDQ: AAPL) with a 1.8 billion euro antitrust fine. That’s about $1.95 billion in U.S. dollars.

The commission determined the Cupertino Giant had restricted other app developers from informing Apple users about cheaper ways to subscribe to music streaming services beyond the App Store.

And according to the EU, this gave Apple’s own music streaming service an unfair edge.

This is one of the largest fines that the EU has imposed on a technology company — and it’s the first antitrust fine Apple has received from the commission.

The European Commission first took up the case in 2019 after receiving a complaint from rival streaming service Spotify (NYSE: SPOT). According to the commission, Apple has been unfairly and unlawfully restricting the business of other streaming services for nearly 10 years.

The company’s actions “may have led many iOS users to pay significantly higher prices for music streaming subscriptions because of the high commission fee imposed by Apple on developers and passed on to consumers in the form of higher subscription prices for the same service on the Apple App Store.”

The EU’s Executive President of the European Commission for a Europe Fit for the Digital Age (what a title) Margarethe Vestager commented that thanks to Apple’s policies, iOS users in Europe have not had “a free choice as to where, how, and at what prices to buy music streaming subscriptions.”

“This is illegal, and it has impacted millions of European consumers.”

For its part, Apple argued that app developers do “compete on a level playing field” in the App Store. The company also said that the EU had made its decision without being able to “uncover any credible evidence of consumer harm.” Apple said that the ruling “ignores the realities of a market that is thriving, competitive, and growing fast.”

Macy’s Receives a Takeover Offer

On Monday, shares of Macy’s (NYSE: M) leaped by nearly 20% in pre-market trading after Arkhouse Management and Brigade Capital upped their bid for the company.

The activist investors now want to take the retailer private in a deal that values the company at $6.58 billion.

The firms had previously offered $21 per share for the remaining shares in the company they didn’t already own. The new offer sweetens the deal to $24 per share.

What’s more, the activist investors are prepared to pay even bigger bucks for the iconic retailer.

“We remain open to increasing the purchase price further subject to the customary due diligence,” Arkhouse said over the weekend.

Macy’s rejected a previous offer from Arkhouse back in January. However, the retailer is reportedly reviewing the new offer.

That’s largely because Arkhouse has said that it even has the lenders to finance the deal — a sticking point from the previous offer.

Macy’s has struggled to compete against cheaper retailers such as Walmart (NYSE: WMT) and e-commerce outlets such as Amazon (NSDQ: AMZN). In addition, the COVID pandemic dealt Macy’s a heavy blow.

Analysts advise that accepting the new offer would be a wise move on the department store company’s part.

“Macy’s should cooperate with the investment group and pursue a possible sale,” Morningstar’s David Swartz said. “If it refuses to do so, it runs the risk of a hostile takeover.”

JetBlue and Spirit Go Their Separate Ways

Citing regulatory hurdles, JetBlue Airways (NSDQ: BLU) and Spirit Airlines (NYSE: SAVE) have called off their planned merger.

JetBlue first bid to acquire Spirit Airlines nearly two years ago. At the time, Spirit and Frontier Group (NSDQ: ULCC) — another low-cost carrier — had agreed to merge. Spirit eventually terminated its agreement with Frontier in favor of JetBlue.

“It was a bold and courageous plan intended to shake up the industry status quo, and we were right to compete with Frontier and go for an opportunity that would have supercharged our growth and provided more opportunities for crewmembers,” JetBlue CEO Joanna Geraghty said in a memo to staff this week.

However, the planned acquisition ran afoul of regulators. A federal judge blocked the deal in January, saying that the takeover would stifle competition and drive up fare prices for consumers.

In his decision, Judge William Young said the sale would “harm cost-conscious travelers who rely on Spirit’s low fares.”

Although JetBlue said it would appeal the decision, eventually the deal fell apart. As stated in the agreement’s termination clause, JetBlue will pay Spirit $69 million.

On the news that the deal was through, JetBlue shares soared, while Spirit took a nosedive.

The low-cost carrier had been struggling but recently reported that higher-than-expected demand had finally set it back on track to profitability.

“Throughout the transaction process, given the regulatory uncertainty, we have always considered the possibility of continuing to operate as a standalone business and have been evaluating and implementing several initiatives that will enable us to bolster profitability and elevate the guest experience,” Spirit CEO Ted Christie said this week.

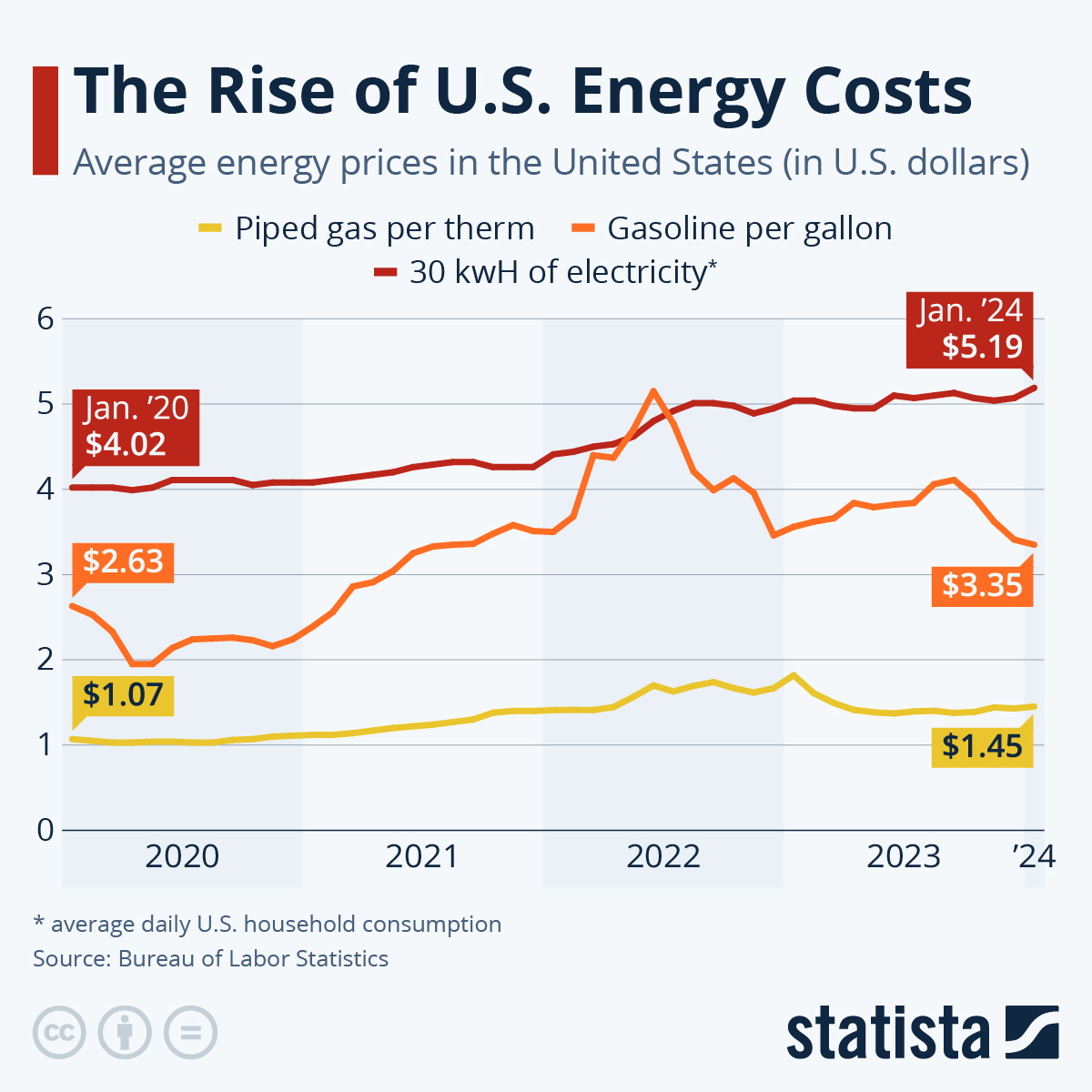

Energy Price Increases Since 2020

Data from the Bureau of Labor Statistics shows how energy prices have increased here in the U.S. over the last four years.

Gasoline — the most volatile of the bunch — saw a big spike at the start of the war between Russia and Ukraine before averaging $3.35 per gallon at the start of the year.

Meanwhile, natural gas prices rose from $1 per therm in 2020 to around $1.45 per therm in January — an increase of around 35%.

However, electricity has shown the most steady increase, rising in a continuous pattern by 30% in the last four years.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

P.S. Don’t miss out on the cryptocurrency boom. The gap between traditional and digital markets is narrowing, as Bitcoin (BTC) soars to new heights.

Bitcoin exchange-traded funds (ETFs) are reporting massive inflows of new capital. The cryptocurrency market has embarked on perhaps the most powerful bull market in its history.

It’s clear that every portfolio should contain crypto assets. However, you need to be informed, to make the right choices. Direct investments in crypto coins or crypto-linked ETFs can be volatile.

In our coverage of the crypto market, we separate fact from myth, the wheat from the chaff. Start receiving our FREE e-letter, Crypto Investing Daily. Click here now!