Rising Costs, the Reddit IPO, and Rivian’s Surprise Announcement

Editor’s Note: Sigh… inflation… sigh…

Let’s get to it.

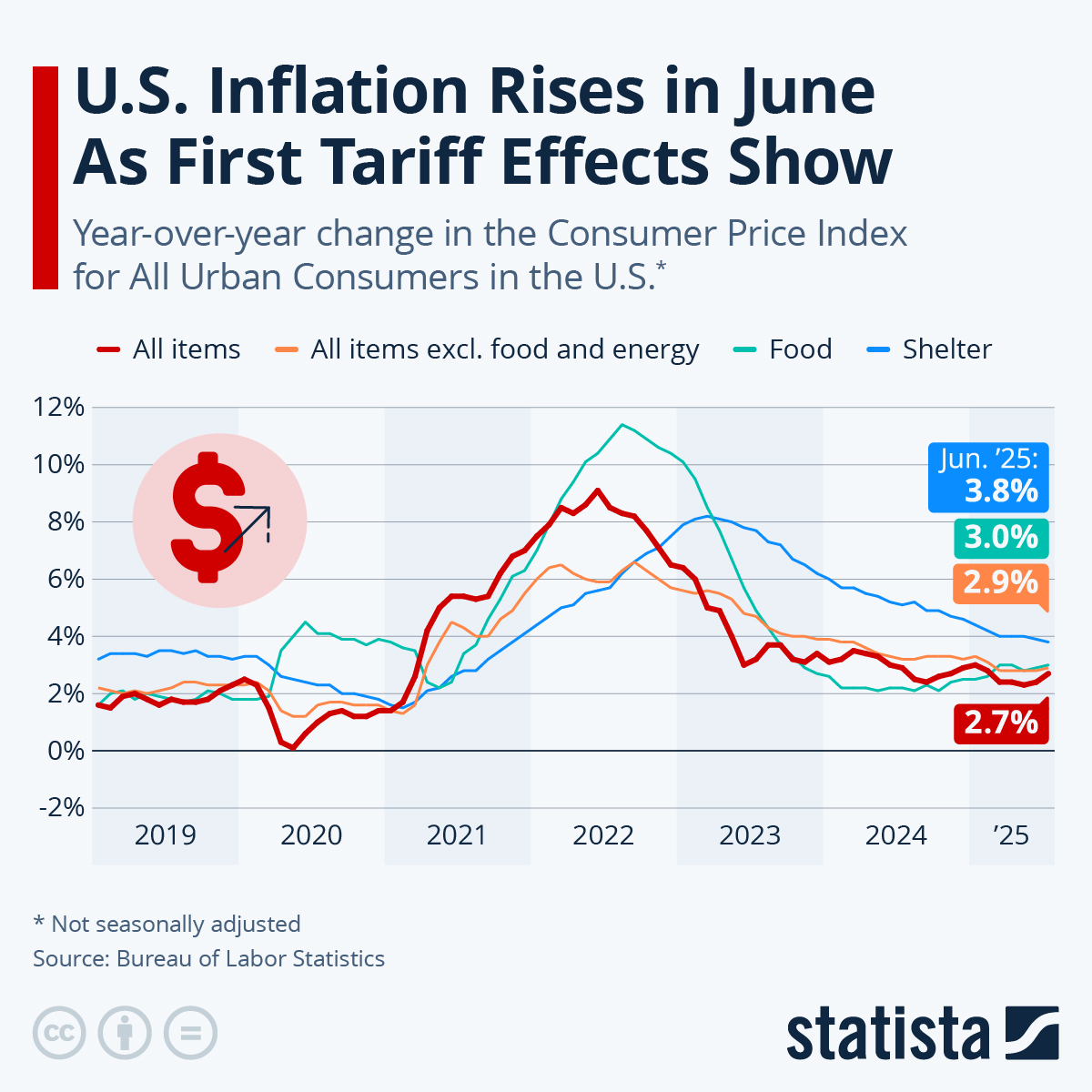

February CPI Comes in Slightly Hotter Than Expected

According to the Bureau of Labor Statistics, the Consumer Price Index (CPI) reading for February was higher than expected.

Prices rose by 3.2% on a year-over-year basis. Not only was that a larger percentage than analysts had been expecting, but it was also higher than January’s CPI reading of 3.1%.

Compared to January, prices rose 0.4% in February. Although that met expectations, it’s still the hottest monthly inflation recorded since last September.

The gasoline and shelter categories were largely to blame for the hotter-than-expected CPI reading.

However, food prices remained flat.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

“Food’s volatile,” Wells Fargo (NYSE: WFC) economist Mike Pugliese told CNN,” and the Fed’s got a lot less control over that… but you want to see [cooler prices] sustained.”

Stripping out volatile food and energy costs, the so-called “core” CPI showed a year-over-year increase of 3.8% — cooler than January’s 3.9% year-over-year rise in core CPI.

Clearly, an interest rate decrease is not in the cards for the next Federal Reserve meeting.

“There is more room to fight on the inflation battle,” David Doyle, head of economics at Macquarie, told CNBC yesterday. “And there’s a bit further to go before everyone goes out and declares victory.”

Meanwhile, as Sung Won Sohn of Loyola Marymount University told CNN, “Inflation is like a bobsled track; it slopes down with many twists and turns. The uptick in the inflation rate supports the Federal Reserve’s ‘go-slow’ approach in cutting the interest rate.”

Reddit Eyes a $6.5M Valuation at IPO

Reddit is planning to go public this month, and the social media company expects to raise as much as $748 million as part of its initial public offering (IPO).

Apparently, the company is also targeting a valuation of $6.5 billion — significantly less than the $10 billion valuation Reddit received during a 2021 fundraising push.

According to a filing with the U.S. Securities and Exchange Commission (SEC), Reddit expects to sell roughly 22 million shares priced in a range of between $31 and $34 per share.

As part of the IPO, the company also plans to sell 1.76 million shares to Redditors — the company’s regular users. Redditors will be eligible to purchase these shares if they had a user account opened before January 1.

Interestingly enough, there’s no “lock-up” period on these shares, meaning there’s no restriction on when Redditors can turn around and sell their shares.

That could lead to some intense volatility in Reddit’s stock once it debuts on the New York Stock Exchange (NYSE).

Now, Reddit played a big part in the so-called “meme stock” push of early 2021. Retail investors talked up investments in downtrodden stocks such as GameStop (NYSE: GME) and AMC Entertainment (NYSE: AMC), leading to massive gains in these stocks.

The only problem with “meme stocks” is that there’s little going on with these companies to support the dizzyingly high valuations they were reaching.

Now it’s looking as if Reddit itself has the potential to achieve “meme stock” status.

“This is an unprecedented situation,” Firstrade’s Don Montanaro recently told MarketWatch. “The meme-stock phenomenon has played out with stocks that were already out and listed for some time. Here we have the debate and the possibility of a stock being a meme stock before it’s even public.”

Reddit itself noted in its SEC filing that “investing in our Class A common stock involves a high degree of risk.”

Hmm… is Reddit banking on its stock being a “viral” hit among meme-stock investors?

Of course, it is!

Anyway, Reddit is planning to trade on the NYSE under the ticker symbol “RDDT.”

The IPO will be the first time a major social media company has made its stock-market debut since Pinterest (NYSE: PINS) went public way back in 2019.

Like many trendy tech companies these days, Reddit has yet to turn a profit. The company reported a net loss of $90.8 million for 2023. However, that’s lower than its 2022 net loss of $158.6 million.

Meanwhile, Reddit’s annual sales last year hit $804 million — a 20% improvement on a year-over-year basis.

Rivian Surprises the Market… in a Good Way, This Time

Speaking of unprofitability… Why have shares of Rivian (NSDQ: RIVN) been on a tear in the last week?

Shares of the electric vehicle (EV) maker have zoomed up by more than $17 apiece since last Thursday.

It all has to do with a new vehicle launch.

Last week, Rivian unveiled its newest EV, the R2. According to the company, the R2 will be a midsize SUV with a somewhat affordable price tag — $45,000.

In addition, Rivian surprised Wall Street by announcing it will also start building a smaller crossover model, the R3, along with a luxury version, the R3X.

Now, before the news broke, Rivian had spent the start of 2024 in the proverbial doghouse. After starting out the year with shares above $21, RIVN came crashing down to just above $10 by the end of February.

Due to the abundance of high-priced EVs currently on the market, investors were certainly intrigued by the promises of the R2.

That $45,000 price tag is far below the starting prices of Rivian’s current models — the R1T (at $71,700) and the R1S (at $76,700).

According to Rivian, the R2 — which is intended to compete with the best-selling EV here in the U.S., Tesla’s (NSDQ: TSLA) Model Y — will have up to 330 miles of range and seat five.

Rivian is hoping the affordable nature of the new vehicle will be key to bringing its products to the mainstream.

“I’m so excited about what this vehicle represents in terms of achieving scale,” CEO R. J. Scaringe said. “R2 represents not only a vehicle but a platform.”

Rivian also announced that it will delay the construction of its $5 billion EV factory in Georgia. Instead, it will start producing R2 models at its existing facility in Illinois.

According to Scaringe, this decision will allow the company to bump up the launch date for the R2 to 2026. In addition, the company will also save $2.25 billion in capital expenditure by “pausing” the Georgia project.

P.S. Don’t miss out on the cryptocurrency boom. The gap between traditional and digital markets is narrowing, as Bitcoin (BTC) soars to new heights.

Bitcoin exchange-traded funds (ETFs) are reporting massive inflows of new capital. The cryptocurrency market has embarked on perhaps the most powerful bull market in its history.

It’s clear that every portfolio should contain crypto assets. However, you need to be informed, to make the right choices. Direct investments in crypto coins or crypto-linked ETFs can be volatile.

In our coverage of the crypto market, we separate fact from myth, the wheat from the chaff. Start receiving our FREE e-letter, Crypto Investing Daily. Click here now!