Every Investor Should Ask These 4 Important Questions…

Joan R. Ginther has won the lottery four times.

First, it was a measly $5.4 million. Then $2 million. Then, $3 million, and finally, in 2008, the Texas native hit a $10 million jackpot.

They say luck is what happens when hard work meets opportunity, but this could be an exception. It seemed like Ginther was simply the most fortunate person alive. Then, people started taking a closer look…

Ginther wasn’t just a simpleton who’d lucked into boatloads of cash. She earned a Ph.D. in Statistics from Stanford University. And she had purchased approximately 80,000 lottery tickets in her lifetime.

Suddenly, it all started to make sense. While Ginther hasn’t publicly given any interviews to reveal her secret, it clearly wasn’t luck. It was preparation.

Fortunately, for those who can’t stomach fronting thousands of dollars buying lotto tickets to see returns, the stock market presents a less risky, more time-tested method of making money. But even if you’ve bought stocks instead of a stake in the lottery, preparation is still a vital ingredient in enjoying hefty returns.

If you can prepare by answering these four simple questions about yourself, your odds of successfully investing increase exponentially…

4 Questions To Raise Your Odds

1) What are my ultimate goals? You start a trip with a destination in mind. Are you saving and investing for a child’s college tuition? Retirement? A dream vacation? All three? If so, calculate how much you’ll need, and don’t forget about inflation. Then, you’ll have a realistic idea of how much to set aside and what returns you need to reach your goals.

2) What is my age? A retiree no longer drawing a salary and living off their nest egg can’t afford to take the same chances as a recent college graduate. The old rule of thumb for equity exposure is 100 minus your age. So a 40-year-old investor might keep 60% of his portfolio in stocks versus just 30% for a 70-year-old. This is a simple but reasonable guideline for many people. The point is to build wealth during the early years and then protect it during the later years.

3) What is my risk tolerance? How would you react to a market decline of 10%, 20%, or 30%? Nobody likes volatile, stomach-churning price swings or the thought of losing hard-earned money. But you probably won’t reach your goals by playing it safe and leaving all your money in Treasury bonds paying 2%. Risk and reward go hand in hand. Don’t lose sleep at night — try to find a comfortable balance.

4) Do I want international exposure? Are you more comfortable sticking with U.S. companies, or do you want to explore opportunities abroad? Remember: more than half of the world’s market capitalization now resides outside our borders. International markets can offer higher yields, stronger growth potential (in some cases), and exposure to foreign currencies that may shelter a portion of your money from any devaluation of the dollar. (I wrote more about the case for international high-yielders here.)

Closing Thoughts

There is no “right” answer to these four questions, but your answers will allow you to develop a strategy and criteria for potential investments. Maybe you’re a 51-year-old with a low risk tolerance. Or perhaps you’re 22, and your goal is to build the foundation for a retirement that’s decades away.

Once you’ve identified your goals and time frame, it’s time to find some winners that fit your profile.

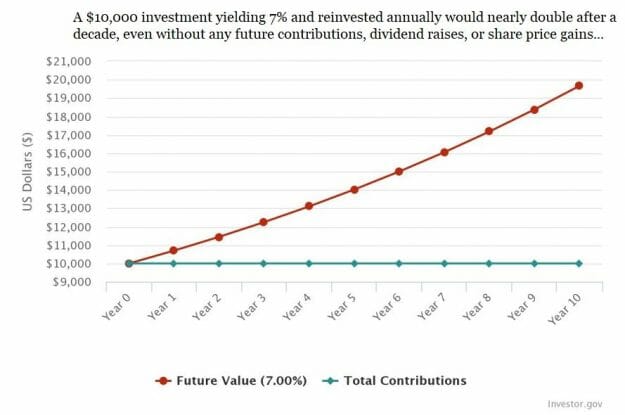

A word of caution, though. Even though you may be in the later stages of your investing career, you still have time. You might not have as much time as your younger self, but you can still harness the power of compounding in just a few years. For example, here’s a graphic I’ve shared before, which shows what just a decade of dividend reinvestment can do for you (without anything else).

Even though preparing your investing strategy by answering those four questions is crucial, it’s only useful with the ability to identify investments that fit your criteria and achieve your investing goals perfectly.

That’s where my team and I can help.

Over at my premium advisory service, High-Yield Investing, I research and present some of the best income opportunities the market offers. Regardless of your risk tolerance, goals, or ideal time frame, income payers deserve a place in every portfolio.

Check out my latest report if you want to know about my favorite high-yield picks. You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.