The Perfect Way To Make Income In A Sideways (But Volatile) Market

Another day, another epic battle between the bulls and the bears. To be sure, each side has compelling arguments.

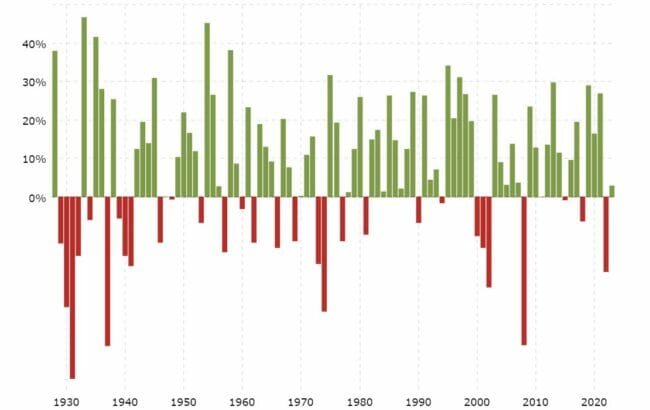

From the bullish perspective, we are coming off a year in which the market lost almost 20%. We’ve only seen three declines of that magnitude since 1957, and each time stocks rebounded the following year powerfully.

It’s exceedingly rare for stocks to register back-to-back annual losses, having last occurred following the dotcom crash.

Source: Macrotrends.net

Prices remain favorable, with the S&P trading at 17.5 times earnings, a discount to both 5 and 10-year historical norms. Meanwhile, the labor market continues to chug ahead, adding another 311,000 jobs last month. And inflation, particularly at the wholesale level, has cooled substantially in the past few months.

But other macro indicators don’t look nearly as supportive.

Manufacturing activity has just contracted for the fourth straight month. Retail sales are sliding, particularly for discretionary items like home furnishings. Big box chains like Wal-Mart and Home Depot have sounded the alarm, saying that U.S. consumers have grown weary.

Businesses have also become more circumspect and could trim their spending budgets. Debt-fueled growth will almost certainly slow as borrowing costs continue to rise.

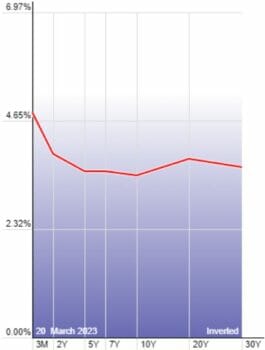

Let’s not forget the deeply inverted yield curve, which has preceded every recession since World War II.

Source: Stockcharts.com

It’s no coincidence that 148 major companies alluded to “recession” worries on their latest conference calls. And the slowdown is already taking a toll on corporate profits. According to FactSet, S&P earnings are projected to drop 6.1% next quarter, the steepest decline since the pandemic lockdowns in the spring of 2020.

If that weren’t enough, new revelations, credit downgrades, and outright scandals are coming to light, causing upheaval in the banking industry. Questions of financial stability haven’t yet been answered. Clashes over the federal budget deficit and debt ceiling are another potential concern.

Let The Pros Do It For You…

Against this backdrop, I don’t see the major averages making much net headway over the next few quarters. You might describe my outlook as neutral. That doesn’t mean listless. There will be volatility, but it may be evenly disbursed. One step forward, one step back. We’ve certainly seen that recently. As I write this, the Dow is giving back nearly 600 points after gaining 600 the previous day.

Last week, I wrote about the benefits of selling covered call options for extra income. And I did this for a good reason… covered calls are ideal in market conditions like what I outlined above.

But here’s the thing… Not everyone is comfortable trading individual options. That’s okay. For those of you who’d rather leave this technique to the pros, there’s still a way to participate. There are funds that take this concept and apply it on a much larger scale.

If 100 shares of Coke can generate $200 in yearly premium income, then 1,000 shares can give us $2,000, and 10,000 shares can net $20,000. So, imagine the income potential for a fund that holds hundreds of thousands or even millions of shares.

Fortunately, a unique class of securities is custom-built to propel your portfolio even when the wind goes out of the market’s sails. These funds don’t just muddle through flat conditions – they thrive on them. In fact, we already held one of them in my High-Yield Investing portfolio — and we just added another last week.

The Hands-Off Approach

Take the Nuveen Dow 30 Dynamic Overwrite (NYSE: DIAX). The fund invests in the 30 Dow Jones Industrial Average members and collects dividends on each. But unlike a plain vanilla index fund, it also sells covered call options to generate additional income and enhance risk-adjusted returns.

The fund holds 118,000 shares each of Boeing (NYSE: BA), Cisco Systems (Nasdaq: CSCO), Coca-Cola (NYSE: KO), and Walt Disney (NYSE: DIS), among others. And it sells options on roughly half of the fund’s holdings, sweetening the dividends with premium income that allows for a robust distribution of 7.5%.

Keep in mind there are different applications of this strategy. Within the options section of the portfolio, there are three factors you’ll want to consider… the average strike/current stock price ratio, weighted average number of days to expiration, and average call option overlay as a percentage of total fund assets.

These metrics will yield insight into how much potential appreciation the fund manager is willing to trade away for current income. These covered call funds (also known as “buy-write” funds) usually have an options overlay representing between 30% and 60% of assets. That’s enough to enhance income and be an effective risk management tool while leaving the rest of the portfolio unencumbered to participate in a rising market.

These funds will usually lag in a runaway bull market, but that’s to be expected. They perform best in sideways to slowly advancing markets but can also limit the damage in any selloff. Case in point, DIAX slipped just 3% last year, while the Dow itself fell about 9%.

Closing Thoughts

You can benefit from the extreme price swings we’ve seen recently. Remember that $0.50 per share option premium I mentioned in my previous article? It’s not set in stone. Premiums can vary wildly from a few pennies to several dollars per share, depending on certain variables.

The more a stock price fluctuates, the more profitable a call option can be. And the more buyers are willing to pay. That’s always a good thing when you’re on the selling end of the transaction. In other words, this market volatility can be an ally.

As one final incentive, consider that covered-call funds can support outsized distributions without leverage. Most do NOT borrow money, making them less vulnerable to rising rates than other closed-end funds. Of course, they’re not all created equal.

If you’re looking to ride out what may be a sideways market (and earn a nice income stream to boot), then you should give these funds a look.

Over at High-Yield Investing, we own Blackrock Enhanced Equity Dividend (NYSE: BDJ). This fund has rewarded us with a total return of 55%. But my most recent recommendation just might be even better. This fund is a newcomer, but it’s already attracted over $20 billion in assets in less than two years. With rock-bottom costs and a double-digit payout, you can understand why.

In the meantime, to know about my absolute favorite high-yield picks, you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.