This Natural Gas Pioneer Is STILL Offering A Favorable Setup To Investors…

Last year, I spent a lot of time writing about the new “boom” in the energy sector. I also offered several ways for investors to profit in a handful of my articles.

For example, back in May I wrote about one company that was a trailblazing pioneer in the sector: Chesapeake Energy (Nasdaq: CHK).

In that article, I mentioned that my premium readers and I were already up by about 30% on CHK — and that I thought the stock was offering investors a compelling opportunity.

I also told readers about how it was almost singlehandedly responsible popularizing a lateral drilling technique to free natural gas from unconventional shale formations. This technique is otherwise known as “fracking” — and it’s used by every oil and gas producer around the world today.

Few people know or appreciate the story behind this — and how it helped turn the United States into a global energy powerhouse.

But then, the company fell on hard times. Here’s how I summed it up in my original piece:

Between 2003 and 2007, Chesapeake spent billions acquiring assets in nearly every major energy field in the U.S. It became the second-largest producer of natural gas, trailing only Exxon.

In some ways, Chesapeake became a victim of its own success, as other companies followed its lead and US energy production soared… driving down prices.

As Chesapeake was expanding at breakneck speed, natural gas prices were near $20 per million British thermal units (BTU). But as Chesapeake and other companies flooded the market with gas, it sent prices well under $2.

Then the financial crisis hit in 2008 and put even more pressure on energy prices. Shares of Chesapeake also tumbled.

You can probably guess how it all ended. But you can read the original article for more details. Bottom line, Chesapeake had racked up an overwhelming amount of debt (nearly $13 billion). Shares fell more than 90%. And finally, in June 2020, the fracking pioneer entered Chapter 11 bankruptcy.

Where CHK Stands Today…

Now, a lot has changed since then. CHK has risen from the ashes and is trying to earn back the trust of investors. And as I said last year, that — combined with a bullish picture for energy — offered a rare combination of value and growth.

So let’s take a look at where Chesapeake stands today.

CHK reported quarterly earnings results on May 2. The company beat earnings and sales estimates, but shares slipped on the recent volatility in natural gas.

This chart tells the story…

Over at Capital Wealth Letter, our investment in Chesapeake Energy has been nearly as wild, with shares shooting up over 70% in the 10 months after I recommended the stock in February 2022. They’ve drifted lower since peaking in December, but we’re still up — and I think the stock still offers a compelling opportunity today.

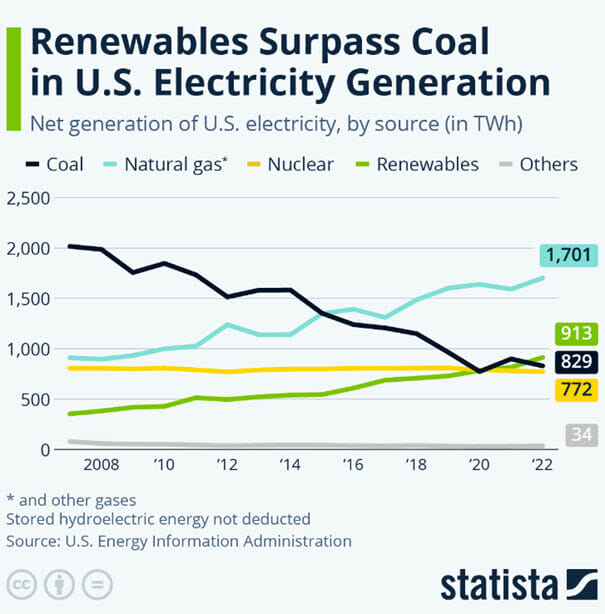

The good news is that if you missed the boat, there’s still time. I’m still bullish on Chesapeake and the natural gas space in general. As we move to a cleaner energy future, we’re going to need natural gas. That shouldn’t be a controversial statement, either, since it’s what is already happening. Take a look…

Action To Take

So, yes, natural gas prices are down, and shares of CHK have followed suit. But I’m not too worried — I think the long-term picture is bright.

Back in my previous article, I said “All signs are pointing towards Chesapeake restoring its former glory.” But remember, the company is working its way back from bankruptcy. And it’s going to take some time for it to prove itself with investors.

In the meantime, its dividend yield is an eye-popping 11.8%, largely thanks to the “variable” dividend it pays out, which is based upon its free cash flow. Please note that when they say “variable,” they mean it. Its latest variable dividend was $0.74 per share; the one before was $2.61 per share. That quite the variance.

Regardless, so far, Chesapeake is doing all the right things, and I still think it’s worth a look for investors today.

P.S. If you’re looking for game-changing investment ideas with serious upside, then you should check out my investment predictions report…

This report is full of research that challenges the conventional wisdom. And while we don’t have a crystal ball, many of our past predictions have come true, allowing investors the chance to rake in gains of 622%, 823%, and even 1,168%.

From the U.S. dollar to driverless trucks to breakthrough cancer treatments and more… If you’re looking for some “home-run” ideas for your portfolio, then I can’t think of a better place to start.