The One Big Reason To Invest In Commodities Right Now…

A few days ago, I wrote a couple of articles that might be considered controversial.

The first was a look at the so-called ESG movement. (For the record, I have nothing against trying to achieve more equality or being more environmentally friendly. It’s just that, as I explained in the article – some companies are duping well-intentioned investors and losing them a lot of money in the process.)

The second article made the case for coal. (You can read it here.)

So today, I want to follow up on this by making some related comments.

If you’re bullish on my coal short-term coal thesis like I am, it’s just one more reason to be bullish. And if you’re not so sure, well, then what I am about to talk about is one reason to consider commodities and energy names in general.

Let me explain…

Why History Says We Should Invest In Commodities

Look, right now, everyone is focused on AI and other big tech gadgets. Investors have left boring energy stocks in the dust. Today, energy is by far the cheapest sector in the S&P 500… and as I explained in my previous article, coal is the cheapest, and most hated, among the energy cohort.

But history tells us that times like these are exactly when we should be investing in commodities. Because we could be near a commodity supercycle.

What is a commodity supercycle? Well, that’s when prices of commodities rise above their long-term averages for long periods of time. The last supercycle started in 1996 and ended in 2016.

Commodity prices have reached a 50-year low relative to overall equity markets as measured by the S&P 500. Historically, lows in the ratio of commodities to equities have corresponded with the beginning of new commodity supercycles.

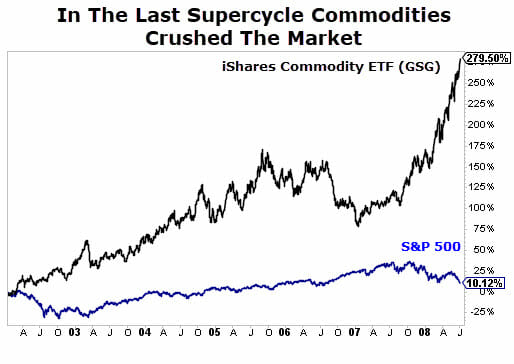

Take a look at the infographic below:

Commodities are notorious for their boom-and-bust cycles. If you can catch one of the booms and avoid most of the bust, you can make some spectacular returns.

If we had followed the above chart and bought the iShares Commodity Index ETF (NYSE: GSG) after the 2000 tech bubble and rode it to 2008 when the commodity-to-equity ratio peaked, we would have crushed the broader market. And it wouldn’t have even been close…

Closing Thoughts

That’s how powerful these supercycles can be. They can deliver market-crushing returns.

I can’t predict the future. But here’s what I do know… people like their electricity even if it means getting it through not-so-environmentally friendly ways. Coal remains the world leader in producing such electricity. And with natural gas being in short supply, countries are turning to coal to pick up the slack.

Of course, there are some risks to consider. Environmental and regulatory concerns, to name one. Also, if the Russia/Ukraine conflict suddenly ends and Europe somehow mends ties with Russia to receive natural gas, they could quickly shut down those coal plants they just fired up.

But if we are entering a supercycle, well then, that could supercharge returns. Not only from coal – but from all types of commodities.

If you want broad exposure, the iShares Commodity Index ETF (NYSE: GSG) mentioned earlier is a good place to start.

In the meantime, my colleague Nathan Slaughter has found an oil stock that’s set to pop…

Located on the West Texas prairie, one tiny company is sitting on the largest oil reserve in history… with enough black gold to independently power America for the nest 49 years…

You won’t see this covered on the nightly news… But some heavy hitters are making making big investments in this area — and this little-known company stands to profit the most. Go here for details now.