My Favorite “Digital Landlord” Is Still A “Buy” – Even After A 45% Rally…

If you’re a regular reader, you may recall that I’m a big fan of what I call “digital landlords.”

Here’s what I mean.

Five years from now, do you think people will stream fewer shows on their TVs or smartphones? Or more?

Five years from now, do you think people will stream fewer shows on their TVs or smartphones? Or more?

Will they post on social media less — or more? What about e-commerce? Smart devices?

What about the latest burgeoning field… artificial intelligence (AI)?

These are the growth catalysts in place for digital real estate. Or, to put it another way, the real estate investment trusts (REITs) that focus on data centers.

Here’s how I made the basic case for these “digital landlords” in a recent article:

“…all that data has a physical home, most likely in a rack of servers somewhere. That hardware takes up a lot of space. It also draws exorbitant power and needs cool environments to keep from overheating. Most IT departments have found that instead of keeping all this equipment in-house, renting space in a dedicated facility makes financial sense.”

Big Plans For The Future

My favorite “digital landlord” — Digital Realty (NYSE: DLR) — is already capitalizing with 300+ facilities on six continents. New leases signed last quarter alone stand to bring in $114 million in annual rental income.

But, management is preparing to meet future demand with an ambitious development pipeline encompassing 9.2 million square feet. For context, these facilities are fetching $144 per square foot on average in yearly rental income– compared to around $25 for standard retail space.

That’s an aggressive buildout. There’s just one small roadblock: funding. As you might imagine, building a state-of-the-art hyperscale data center from the ground up is a costly endeavor. Management has set a spending budget of $2.3 to $2.5 billion this year.

Unfortunately, rising interest rates have driven borrowing costs sharply higher. There isn’t much room on the balance sheet anyway, with $17.7 billion in current outstanding debt (equal to 6.8 times EBITDA). The company can always print new shares. In fact, it issued 7.8 million last quarter at an average price of $96 per share, hauling in around $745 million in proceeds. But this capital also comes at a price and is dilutive to existing shareholders.

With both options losing their appeal, some were speculating that DLR might strengthen its cash position by cutting back its generous dividend distributions. Thankfully, that option is off the table for now, thanks to some creative financial engineering.

The Latest

A few weeks ago, management reached an agreement to sell an 80% ownership interest in three Washington DC-area data centers to a group called TPG real estate for $1.3 billion in cash. DLR will retain a minority 20% stake and continue to manage the properties.

This follows a similar deal in June whereby DLR sold a 65% interest in two Chicago data centers for $743 million. Since then, the company has amped up its partnership with Brookfield Infrastructure (which is expanding its own digital real estate portfolio) to develop new sites in India. This particular agreement won’t yield any upfront cash, but it will allow DLR to share future development costs of these properties.

Tack on the $90 million profit from the sale of a non-core Texas center last quarter, and management has quickly raised the bulk of its funding goal – without stretching the balance sheet, raising the share count, or tampering with dividends.

Action to Take

The market has rewarded DLR for executing on its capital recycling plan, driving the stock from $86 in late May (when I last wrote about it) to more than $125.

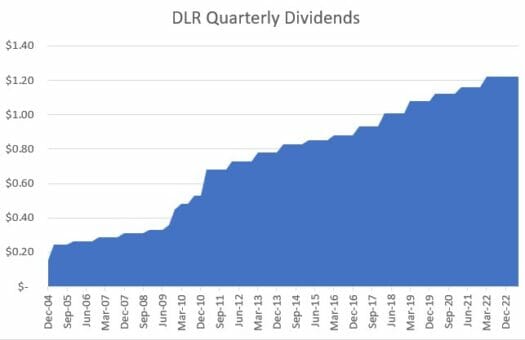

Meanwhile, thanks in part to strong re-leasing spreads on renewals, the company is eying $6.60 per share in core funds from operations (FFO) this year, potentially allowing for an 18th consecutive annual distribution increase.

Over at High-Yield Investing, we’re up big on DLR since adding it to our portfolio. I continue to rate it a “buy” for new investors.

In the meantime, if you want to know about my absolute favorite high-yield picks, you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.