One Of My Favorite Banking Picks — Is It In Trouble?

If you caught the video (and accompanying article) I did recently, then you are aware of the trouble brewing in commercial real estate (CRE). If not, let me fill you in quickly.

Many property owners struggling to meet payments (or refinance) are simply walking away from mortgages. The biggest sore spot is in the office sector, where remote work arrangements continue to sap demand for cubicles. Every employee completing daily tasks at home is one fewer person clocking in at the office. With vacancies rising, suffice it to say that net operating income (and thus property valuations) have taken a dive across many metro markets.

So how bit of a deal is this? Well, let me give you an idea of who has weighed in on the situation. Charlie Munger (Warren Buffett’s longtime associate) said that he sees trouble on the horizon. Jerome Powell said that real estate losses pose a serious threat that is being carefully monitored by his colleagues at the Federal Reserve. And Goldman Sachs also sounded the alarm, calling it the “perfect storm”.

A recent report from MSCI just quantified some of the risks, estimating a $155 billion wave of potential defaults. There is already a substantial amount of distressed debt in the system. Banks have tightened their lending standards, and you can understand why considering the collateral involved.

Now, for reasons I explained earlier, the situation is concerning — but there’s no call for panic. And in a follow-up Q&A video, one reader asked about the situation and how it pertains to one of my favorite banking stocks. I touched on things briefly there, but today, I want to expand on things a little bit further.

How This Affects One Of My Favorite Banking Picks…

One of my absolute favorite banking names — Bank OZK (NYSE: OZK) — is not immune from this mess. While it’s exceptionally well run (having been named the best-performing bank in the nation 13 times), the loan book is tilted somewhat to the commercial side. In fact, you might say that development and construction loans are the bank’s area of expertise – its bread and butter.

Believe it or not, this Little Rock-based lender helped finance quite a few Manhattan skyscrapers, including the 1,000-foot Rabina luxury residential tower on Fifth Avenue. According to the Wall Street Journal, construction loans account for $7.7 billion (around 40%) of the bank’s portfolio.

Let’s be clear. OZK works with highly experienced developers and only finances about half of a project’s total cost. Seldom do these loans go sour. In fact, its charge-off ratios for bad loans have outperformed the industry average every single year of its existence – 26 times in 26 years. That speaks to careful and disciplined lending.

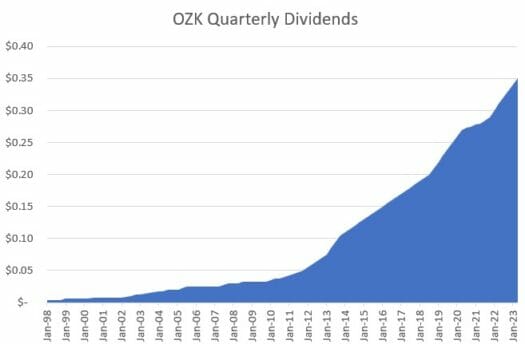

Like its peers, OZK is setting aside a larger provision for potential credit losses. But non-performing loans currently represent a scant 0.15% of the portfolio; credit quality has actually been strengthening. Did I mention the bank has also raised dividends for 52 consecutive quarters?

Action to Take

But as they say, past performance is no guarantee of future results. With the skies darkening, I am assessing the potential risk of deteriorating commercial real estate sector conditions. We will know more as bank earnings are released.

But given the hasty advance from $31 to the current $40 in just three months, it may be wise to take a “wait and see” approach – due more to valuation than anything else.

But remember, I’ve pointed out before that it’s important to understand that other real estate subsectors are still seeing strong demand. We have plenty of exposure to other areas of real estate in our High Yield Investing portfolio, and you should, too.

In the meantime, how would you like to get paid from some of my absolute favorite high-yield picks?

If that sounds appealing, then you need to check out my report. You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.