2 Stocks That Could Raise Dividends In October

It’s that time again. As autumn approaches, our gaze turns to stocks raising dividends in October.

But income investors are facing a bit of a conundrum right now. A risk-free 3-month Treasury Bill yields about 5.5%. The average S&P 500 stock, meanwhile, yields less than 2%.

On the face of it, the average stock might seem fraught with risk. So, what makes these dividend growers so special?

Consider this…

Time and time again, studies have shown that companies that consistently grow their dividends have historically outperformed. They also had a lower standard deviation of returns compared to non-dividend-paying stocks, indicating lower volatility.

So trust me when I say this. When we look for stocks raising dividends in October, we don’t do this just for fun.

As Chief Strategist of High-Yield Investing, it’s part of my job.

I make a regular habit of looking for dividend hikes each month for my premium readers. Then, I share my findings with the public.

We’re looking for great ideas to potentially include in our portfolio… Companies posting outsized double-digit increases, and reliable dividend-payers that have been steadily growing payouts for a decade or more.

Ideally, we like to find potential hikes that could happen over the next four to six weeks. I also highlight noteworthy special distributions on the horizon. (Check out our analysis for September and August.)

This month, I’d like to highlight two stocks raising dividends in October that you might want to consider. If you’re looking for a potential addition to your income portfolio, you might want to take a look…

2 Upcoming Dividend Hikes For October

1. McDonald’s (NYSE: MCD)

There’s something to be said for brand loyalty, and the Golden Arches stays packed with devoted customers morning, noon, and night.

The typical location generates about $2.6 million in annual sales – more than double the industry average for quick-serve restaurants. And there are nearly 40,000 locations in 100 countries worldwide. Independent franchisees own 95% of those stores, feeding the parent company a steady, annuity-like stream of cash royalties.

After nearly half a century (46 straight years) of dividend hikes, this Dividend Aristocrat now serves up more than $1 billion in quarterly dividends. And starting next month, that payout will likely be headed upward once again.

Quarterly payouts rose to $1.29 per share in October 2020, climbed to $1.38 per share in October 2021, and bumped to $1.52 last October. While many Dividend Aristocrats raise dividends by a penny or so annually, McDonald’s dividend growth has accelerated into double-digit territory.

Management has committed to “reinvesting in the business to drive profitable growth” and returning all excess free cash flow to shareholders.

And there will be plenty of that.

Thanks to healthy double-digit growth in system-wide sales, net income through the first half of 2023 is running at nearly 80% of last year’s pace. Much of that is due to restructuring charges and tax settlements. But profits are still up by 20%, excluding those one-time items. Management credits increased store traffic as well as strategic menu price hikes.

If the pattern holds, investors will be treated to another dividend hike in October, possibly to around $1.60 per share, or $6.40 annually.

2. Visa (NYSE: V)

Most dividend investors quickly glance at Visa’s sub-1% yield and walk right by. That’s a mistake – and not just because the stock has delivered market-crushing returns year after year.

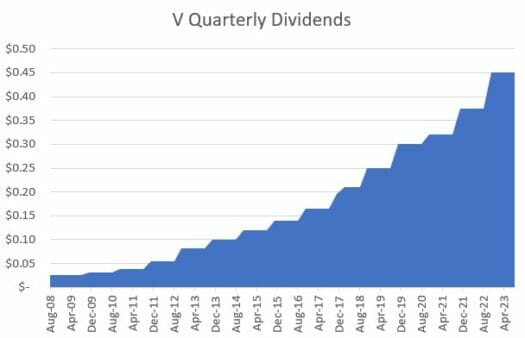

Visa’s payout may seem stingy on the surface, but only in relation to its swiftly rising share price. Dividends have nearly doubled over the past five years, rising from $0.25 to $0.45 per share. That’s a compounded annual growth rate of 13%.

But Visa shares have increased from $140 to $240 over the same time frame, keeping the yield pinned down.

Not a bad problem to have.

Visa’s dominant card processing network forms a near-impenetrable economic moat that can handle 65,000 transactions per second. The company expedites retail purchases in nearly 200 countries across the globe, facilitating $10+ trillion in payment volume last year. And it has a long growth runway ahead as the world shifts toward contactless electronic transactions.

The company processed 54 billion transactions last quarter, cementing its role at “the center of money movement” while driving revenues up 12% to $8.1 billion. From that, the highly efficient business pocketed $4.2 billion in net income. In other words, it turned every dollar of sales into 50 cents of profit, a nearly unrivaled margin.

Visa has faithfully raised dividends for 15 straight years. And with a conservative payout ratio of around 20%, there is ample room to extend that streak. Last year brought a meaningful 20% hike. A similar growth trajectory would drive annual payouts past $2.00 per share next year and $3.00 within three years.

Action To Take

We’ve had a pretty good run of finding solid ideas from this exercise, so it pays to follow along each month. Some of them end up paying off big time. So, if you’re on the hunt for stocks raising dividends in October, these suggestions are a great place to start your research.

But remember, just because I highlight stocks that are likely to increase dividends doesn’t necessarily make them “buys.” These are merely ideas to get you started in the hunt for high yields.

And if you want to know about my absolute favorite high-yield picks, you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.