5 Key Findings From The Top Money Manager Portfolios

If you’ve been around for a while, you already know that my staff and I are pretty fond of Warren Buffett.

We frequently quote his sage (and colorful) advice. I truly believe there is more wisdom contained in Buffett’s annual shareholder reports than can be learned in any graduate-level business class.

More importantly, he puts that advice into practice daily. That’s not to say Buffett doesn’t ever swing and miss (he’s still human, after all). But they don’t call him the Oracle for nothing. Since setting up shop at Berkshire Hathaway in 1965, he and partner Charlie Munger have delivered a jaw-dropping 3,787,464% return.

So naturally, we pore over SEC filings to track what they’ve been buying and selling lately. Many people are surprised to discover that Buffet’s vast riches have been methodically built on mature dividend payers. You might even call them boring. Buffett refers to them as the “secret sauce.”

For example, Berkshire Hathaway accumulated $1.3 billion in Coca-Cola (NYSE: KO) stock through 1994. At the time, those shares yielded $75 million in yearly dividends. By 2022, cash dividends had increased to $704 million annually (more than 50% of the original amount invested), and the value of those shares had risen to $25 billion.

In his own words, “Growth occurred every year, just as certain as birthdays. All Charlie and I were required to do was cash Coke’s quarterly dividend checks.”

Of course, we believe in those same tenets over at High-Yield Investing. We look for many of the same traits in portfolio candidates: durable competitive advantages, favorable industry economics, trustworthy and efficient management teams, superior returns on invested capital, and excess free cash flows.

The Hedge Fund Elite

Yet, while Warren Buffett has achieved rock star status among investors, other brilliant financial minds are out there, too.

Take Bill Miller, whose Legg Mason Value Trust famously outran the S&P 500 for 15 straight years. I’ve also been a big fan of Mario Gabelli, who seeks out unique catalysts that can spur companies trading at discounts to their private market valuation (PMV).

And last November, I dedicated an entire issue to legendary Fidelity money manager Peter Lynch. Founder of the growth-at-a-reasonable-price (GARP) school, Lynch landed over a hundred 10-baggers (stocks that deliver 1,000% gains) in his illustrious career.

Why do I bring this up? As I explained recently, I have spent the past few weeks studying the portfolios of 50 top hedge funds, focusing exclusively on those with the best performance and the most popular (and closely watched) managers.

As promised in my previous piece, here are five macro takeaways that appear to be influencing the pros. And as you’ll see, dividends factor prominently…

1.) Traveling and Gambling on the Upswing

This runs counter to the notion that consumers are tapped out. But the evidence would suggest that we are simply prioritizing our spending on experiences (like concerts and sporting events) over things (like furniture and TVs). This is a long-standing trend that I have been banking on over at High-Yield Investing through multiple positions.

Clinton Murray’s Lodge Hill fund has just scooped up 131,000 shares of Expedia (Nasdaq: EXPE). It is also Michael Burry’s largest holding. The travel site booked 90 million hotel room night reservations last quarter. It’s a safe bet that a few of those were on the Las Vegas strip, which is welcoming throngs of visitors, thanks partly to new sports and entertainment venues.

Those guests are spending freely, which explains why several hedge funds have taken a shine lately to Caesar’s Entertainment (NYSE: CZR), whose resorts pocketed over $1 billion in EBITDA last quarter.

2.) Even in Downturns, People Still Have to Eat

They say that food is recession-proof. And while some upper-crust dining establishments may feel the pinch of inflation and belt-tightening, the Golden Arches are as busy as ever.

Ray Dalio of Bridgewater enthusiastically supports McDonald’s (NYSE: MCD). So is Israel Englander. And Steven Cohen.

Mickey D’s can thrive in just about any environment, which explains why the stock has treated investors to 47 straight years of dividend hikes.

The typical location generates about $2.6 million in annual sales – more than double the industry average for quick-serve restaurants. And there are nearly 40,000 locations in 100 countries worldwide. Year-to-date profits are running about 20% ahead of last year’s pace. Management credits this to increased store traffic and strategic menu price hikes.

But hedge funds with outsized positions undoubtedly see further capital appreciation as the company pushes more Big Mac orders through digital sales channels like kiosks and apps, now representing $20 billion in quarterly system-wide sales.

3.) Families Getting the Most Bang for Their Buck

With inflation (particularly for groceries) still running at stubbornly high levels, household budgeting has taken on added importance. And for many, that might necessitate a switch from brand-name cereals and laundry detergents to cheaper private-label equivalents.

You don’t associate high-flying hedge funds with down-to-earth stocks like Dollar General (NYSE: DG) and Dollar Tree (Nasdaq: DLTR), but these off-price retailers typically shine in this climate. That’s why they repeatedly pop up in the portfolios of well-respected managers like Julian Robertson.

4.) Charge it, Please

It’s hard to find a prominent hedge fund without a stake in at least one of the major credit card stocks.

American Express (Nasdaq: AXP) seems to be the favorite (Buffett amassed a $22 billion stake over the years). But there is also considerable support for Capital One (NYSE: COF), followed by Visa (NYSE: V) and Mastercard (NYSE: MA).

We all know there’s a processing fee involved every time we swipe (or tap these days) the plastic.

How else do you think American Express earned $15 billion in revenues last quarter, the sixth straight quarterly record. Across the country, U.S. merchants now handle $7.6 trillion in yearly credit card sales volume, generating approximately $116 billion in fees for card processing networks.

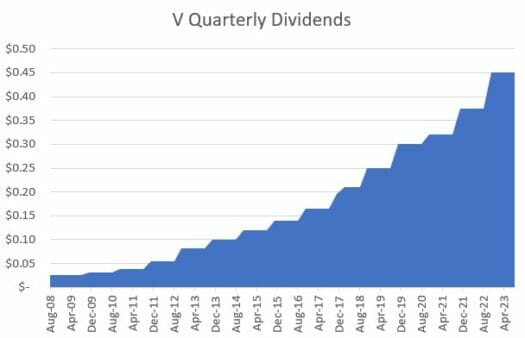

Visa (with 3.3 billion cards in circulation) can process 65,000 sales transactions per second. It processed 54 billion transactions last quarter, cementing its role as “the center of money movement.” And it has a long growth runway ahead as the world shifts toward contactless electronic transactions – the next annual dividend hike will be the 16th straight.

5.) Don’t Count Out Fossil Fuels

There are a few scattered bets on renewable energy, but hedge funds apparently don’t see a meaningful transition away from oil and gas anytime soon.

They own upstream names like Pioneer Natural Resources (NYSE: PXD), which incidentally was just acquired by Exxon Mobil (NYSE: XOM) for $60 billion. They hold pipeline operators as well as downstream refiners like Valero Energy (NYSE: VLO).

Two of the most common holdings are liquefied natural gas (LNG) exporter Cheniere Energy (NYSE: LNG), which is near a 52-week high, and Noble Corp (NYSE: NE), a trusted provider of offshore drilling services. Noble has a $5 billion work backlog and just initiated a new $0.30 per share quarterly dividend.

Closing Thoughts

But I’ve saved the best for last. If two heads are better than one, then how about 44? That’s how many hedge funds currently have a stake in my latest featured recommendation over at High-Yield Investing. That includes Michael Burry, whose Scion Asset Management holds a sizeable stake.

With a current yield of 8%, it might be wise for income investors to follow their lead. To learn how to get more info on this pick, go here now.