Why “Lifetime Income Growers” (Like This One) Belong In Your Portfolio

In a recent article, I wrote about how bigger yields aren’t necessarily better. That’s why part of my strategy for maximizing income over at High-Yield Investing centers on investing in stocks that fall in the high-yield “sweet spot.”

They aren’t the absolute highest-yielding stocks on the market, but these particular stocks tend to outperform all the rest. In fact, one study even found that they returned an average of 14% per year over the past 86 years.

While these stocks are a key part of my portfolio — and consistently provide my subscribers with ample dividend checks — “maximizing yield” is just one aspect of what we do over at High-Yield Investing. So today, I’d like to tell you about another group of income-payers that are a key area of focus — and why they should have a place in any well-balanced income-focused portfolio.

I like to call the second group of stocks “Lifetime Income Growers.” These are the few companies that I think you could buy today and potentially hold for the rest of your life. And while you hold them, they can shower you with bigger and bigger dividends each year…

Introducing: “Lifetime Income Growers”

These stocks have one very distinct characteristic. They are generally dominant companies with growing cash flows that you can depend on to pay — and increase — their dividends year after year. In other words, you likely won’t get a 10% yield from these companies immediately. Instead, Lifetime Income Growers start out with smaller yields but grow their dividends for years on end, often at a fast clip — sometimes even doubling in just a few years.

In short, this is how a “good” yield can often become incredible over time.

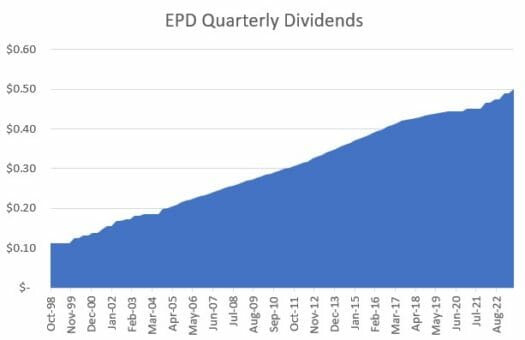

For example, just a few days ago, I told you about Enterprise Products Partners (NYSE: EPD), the largest master limited partnership (MLP) in America.

This MLP owns more than 50,000 miles of pipelines, carrying crude oil, natural gas, petrochemicals, and refined products such as gasoline around the country.

As I said in this article, our economy simply can’t function without EPD’s pipelines. That helps explain why they’ve been able to increase dividends for 25 straight years… and counting.

It’s no wonder, then, that we’ve quadrupled our money on EPD while we’ve held it in our portfolio.

But as you might expect, Lifetime Income Growers are pretty rare. In fact, we only have 11 positions in this section of our portfolio right now. I search for them every month; trust me, they’re not easy to find. I comb through thousands of companies to generate a list of stocks with solid dividend growth track records. Then, I dig into annual reports and SEC filings. I look at everything from historical dividend payout ratios to a company’s competition and pricing power.

After I’m done with my investigation, only a handful of stocks are left that make the cut. But if you buy these stocks today, my experience shows that your income could double within five to six years.

One Of My Favorites…

For example, take a look at one of my favorite holdings, Realty Income (NYSE: O).

Longtime readers know this isn’t the first time I’ve mentioned The Monthly Dividend Company.

You don’t get to call yourself that for no reason. When Realty Income debuted on the New York Stock Exchange in 1994, the company generated approximately $40 million in funds from operations (FFO) annually. Now, it’s churning out that much every few weeks. Because the company is a REIT (real estate investment trust), every penny of that profit is exempt from the tax bite of Uncle Sam. That leaves more cash on the table to be divvied up.

And distributions are paid out monthly, so your interest compounds even faster.

Realty Income began in 1992 with 600 scattered properties. A decade later, the portfolio had doubled in size to 1,200 properties. And then 5,000. Today, this global empire spans more than 13,000 properties.

Most of the firm’s $40 billion portfolio is invested in freestanding retail properties located in prime, high-traffic spots. They are leased to reliable tenants that pay their rent on time each month — like Taco Bell, Circle K, Walgreens (NYSE: WAG), and Regal Cinemas (NYSE: RGC).

With few vacancies and rising rental rates, Realty Income has made 640 consecutive monthly dividend payments, a remarkable stretch that dates back more than 50 years to 1970. Right now, investors are being treated to $3.07 per year. That puts the yield at 6%, more than triple the market average.

The Perfect “Lifetime Income Grower”

Those payouts have risen steadily, not once a year, but every 90 days. In fact, the company has announced 103 consecutive quarterly dividend increases. On average, distributions have been climbing 4.4% annually over the past three decades.

Source: Realty Income Q2 2023 Investor Presentation

There have been some harsh commercial real estate downturns over the past 40 years. But Realty Income has been a steady all-weather performer. Even during the financial crisis of 2008-2009, occupancy rates never dipped below 96%.

Today, they stand at close to 99%, with minimal deviation from quarter to quarter. Part of that stability comes from the deep tenant base. Realty Income’s renters represent 50 diverse industries ranging from fast food to gas stations, most of which are resistant to e-commerce threats.

Second, the properties are typically rented under triple-net leases. That means the tenants (not the landlord) are responsible for property taxes, insurance, and maintenance expenses. That helps minimize the impact of rising upkeep costs and leads to superior margins. Most leases have built-in clauses that stipulate automatic 1% to 2% annual rent hikes.

All of this helps explain why Realty Income’s mailbox keeps filling up with rent checks every month — and why investors haven’t missed a dividend since Richard Nixon was president.

Over at High-Yield Investing, we’re earning more than 8% on our original position — and we’ve doubled our money. With over $7 billion in planned property acquisitions this year alone, this real estate empire should continue rewarding stockholders for many years to come.

Action To Take

Not only do Lifetime Income Growers increase their dividends — but their share prices tend to rise at a faster clip than your average dividend stock. That’s why they’re perfect for investors who want a rising income stream coupled with large gains.

My staff and I recently updated a special report containing a list of monthly dividend payers (like Realty Income) that can get you on the fast track to monthly income. You’ll also learn how my High-Yield Investing strategy works in greater detail. I encourage every reader interested in turbo-charging their income to check it out. Click here to check it out now.