Warning: Don’t Get Suckered By This Bear Market Rally

People are willing to believe anything — especially if it is regarding someone (or something) they care deeply about.

People are willing to believe anything — especially if it is regarding someone (or something) they care deeply about.

This matters a lot when it comes to investing. And no, this isn’t just the cynic in my talking here.

Take the case of Ali Hajaji, for example. When his son fell sick, this desperate father turned to a folk remedy recommended by the village elders… shove the tip of a burning stick through his son’s chest to drain the sickness from his body.

It didn’t work. Perhaps just as startling is that this story isn’t from some faraway time. This was in 2018…

Hajaji told the New York Times afterward, “when you have no money, and your son is sick, you’ll believe anything.”

It seems crazy. But if you desperately need a solution and a good one isn’t readily available, we’ll look for the path of least resistance. In other words, we’ll believe anything.

We think many things in life are true because we desperately want them to be true. And this also applies to the investment world.

We latch onto a stock or investment strategy and defend it as if it were our own child. Even if it is losing us money. Our mother-bear-like emotions are a massive reason why I constantly pound the table on following a non-emotional investment strategy.

The Dangerous Thing About Bear Markets

A large majority of investors are sitting on massive losses right now. According to JPMorgan Chase, personal portfolios in the U.S. fell a heartbreaking 44% between January and October.

When you’re sitting on losses this big, it does a number on your emotional state. Much like Hajaji, you are willing to believe anything. You believe that each of these false rallies is your ticket out. You might average down with the hopes of recouping some losses, but then the rally fails, you’ve lost even more money.

Then the next furious rally comes along and, once again, it ignites a little hope. But alas, the rug is pulled out from underneath you and crushes your soul (and brokerage account).

I bring this up because I know it’s easy to buy into false hope by bear market rallies. We finally see some green in our portfolio and let our guard down. And when the market turns back down, we hold onto hope that it’s just one bad day and the market rally will resume tomorrow.

If this is your strategy or thought process, then I have some bad news for you… You’re going to lose a lot of money.

I’ve been very clear about what my followers and I are doing during this bear market. Take singles and doubles (pull profits off the table) and cut losses short.

This has worked well for us all year. For example, we’ve been buying oil and gas companies all year with some success. We pulled 20% in a few months from Canadian Natural Resources (NYSE: CNQ) earlier this year. Then 19% from Chevron (NYSE: CVX)… 16% from Devon Energy (NYSE: DVN)… 16% from Equinor (NYSE: EQNR)… And over 20% on Texas Pacific Land Trust (NYSE: TPL) in just a couple months.

But it seems the tides are beginning to turn… So we are going to steer clear until things settle back down.

The point is, don’t get suckered into these bear market rallies now. Remember, during bear markets, stocks tend to stage furious short-term rallies. And these rallies can be very dangerous for investors because they lead to false hope.

Bear Market Rallies: Then And Now

Just recall all the false rallies during the dot-com bust…

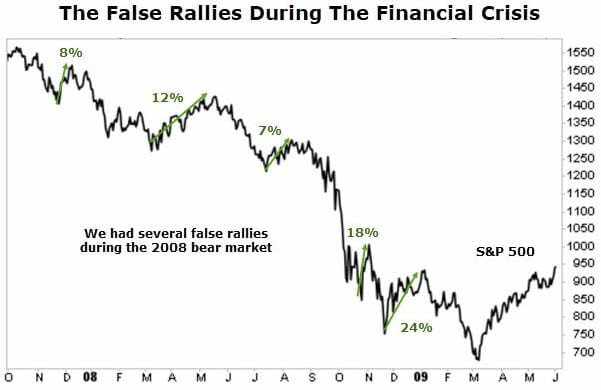

This happened again during the downward spiral of the financial crisis. Stocks staged five bear market rallies, with some of them very prominent-looking rallies (the last one was a 24% gain):

As these rallies happen, they bring false hope to all investors sitting on deep losses. They desperately want to believe that the bear market is over and it is the start of a new bull market. Only to watch the market plunge to new lows.

Eventually, they will be right. Unfortunately, most will have thrown in the towel by then…

We’ve already seen four false rallies during this bear market. And as this goes to print, it seems we are witnessing an end to our fifth bear market rally.

The S&P 500 staged a furious rally from its October lows, but as it approached that psychologically-important 200-day moving average, it again got rejected.

I talked about the importance of the 200-day moving average in this article. Take a look at the false rallies that have happened so far in the current bear market:

Closing Thoughts

I don’t know how many false rallies we will see or when the market will bottom. And quite frankly, I don’t care. I will continue to trade the market how I see it. I will take small swings here and there, pulling profits when I have them while keeping my losses short.

Because one thing I know is that this bear market won’t last forever. And when it’s finally over, we will have plenty of cash on hand to invest heavily.

Until then, we will keep the trading mantra “the trend is your friend” in our minds. And right now, the trend is down.

P.S. If you’re looking for a way to generate steady income in an uncertain market, then you need to turn to Robert Rapier…

Income expert Robert Rapier can show you how to squeeze up to 18x more income out of dividend stocks with just a few minutes of “work” each week.

Up, down, sideways… even in the face of rising interest rates… tech selloffs… overseas war… and anything else Mr. Market throws at you, Robert’s trades are income-generating machines. Click here for details.