Buffett Called Out This Market Theory… Plus: How We Agree About Cash Flow

To most, Saturday, February 25th was just another day. But to diehard investors, it was the day we got our hands on the highly anticipated shareholder letter from Warren Buffett’s empire, Berkshire Hathaway.

To most, Saturday, February 25th was just another day. But to diehard investors, it was the day we got our hands on the highly anticipated shareholder letter from Warren Buffett’s empire, Berkshire Hathaway.

Buffett has penned this wonderful letter for more than six decades. It is a must-read for every investor around the world. It gives us a glimpse into the mind of arguably the world’s greatest investor and is chock full of investing wisdom nuggets.

As a quick example of Buffett’s investing acumen, on the first page of every shareholder letter is the annual investment performance going back to 1965.

Last year, when the S&P 500 lost over 18% of its value, Berkshire produced a 4% return. Since 1965, Buffett has compounded his (and his shareholders’) money at a 19.8% annual clip. That crushes the 9.9% annual gain for the broader market.

I’ve been a student of Buffett for years. His philosophies very much align with what we do over at one of my premium services, Capital Wealth Letter. But what we do over at Maximum Profit couldn’t be further apart.

Buffett is a diehard value investor with a preferred holding period of “forever.” We are not. We are looking to make a quick buck based on a stock’s momentum. Over at Maximum Profit, our average holding period is about six months.

Now, I know we talk about Buffett pretty often around these parts. But I thought it would be interesting to think about Buffett from a different angle — the Maximum Profit angle, if you will. As you will see in a moment, as momentum investors, we may not be all that different from Buffett after all…

We Agree With Buffett About “Efficient” Markets

Believe it or not, as far apart as our investing approaches might be, we have a lot in common with Buffett and his investing beliefs. I was reminded of this as I was reading his latest shareholder letter.

Here’s what Buffett said (bolded for emphasis):

“It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. ‘Efficient’ markets exist only in textbooks. In truth, marketable stocks and bonds are baffling, their behavior usually understandable only in retrospect.”

We might attack investing from different angles, but Buffett and I can fully agree on one thing… the “Efficient Market Hypothesis” is bullshit.

For the uninitiated, the efficient market hypothesis states that the market reflects all relevant information about a company in the stock’s current price. Therefore, it is impossible to consistently beat the market over the long run.

On the surface, this theory makes sense. Especially now, in the information age, where both professional and individual investors can easily and instantly access and act upon all the relevant data and news about a company. Their buying and selling decisions usually create a rational and balanced market.

The efficient market hypothesis holds that any sort of long-term market outperformance an investor achieves is pure luck, not skill.

The man who coined this idea, Dr. Eugene Fama, is a Nobel Prize-winning economist. But even Dr. Fama couldn’t explain the anomaly that is momentum. In fact, in an interview at Alpha Summit, he said, “Of all the things that I think are potential embarrassments to market efficiency, [momentum] is the primary one.”

We like to think that as momentum investors, we share some common ideas with Buffett — particularly about investor behavior and market inefficiency. We just speak different languages…

Buffett looks for stocks that have been deeply discounted to the point where he believes the market isn’t truly reflecting the value of the underlying business in its stock price. This speaks to the idea of an inefficient market caused by the irrational behavior of investors.

We approach investing from the other side of the spectrum. In Maximum Profit, we seek to identify stocks beginning to soar due largely to investor reaction to positive news, earnings, or other developments. Once we identify what we call our “growth window,” we buy. We then ride the momentum, and as exuberance sets in, we use our sell signals to get out when the trend loses steam.

Value investing and momentum investing may seem diametrically opposed to each other. But when you look at it in this light, it should be clear that both are pretty contrarian in nature. At the heart of each strategy, you’re essentially trading on other people’s irrationality and how they affect the market.

We Also Agree With Buffett About Cash Flow…

This rant by Buffett in his latest shareholder letter also resonated with what we do at Maximum Profit.

Here’s what he said:

“Finally, an important warning: Even the operating earnings figure that we favor can easily be manipulated by managers who wish to do so. Such tampering is often thought of as sophisticated by CEOs, directors and their advisors. Reporters and analysts embrace its existence as well. Beating ‘expectations’ is heralded as a managerial triumph.

That activity is disgusting. It requires no talent to manipulate numbers: Only a deep desire to deceive is required. ‘Bold imaginative accounting,’ as a CEO once described his deception to me, has become one of the shames of capitalism.”

It seems we both agree that companies can easily manipulate earnings. In fact, just a couple weeks ago, I revised and updated one of my all-time favorite diatribes about how earnings can be (and are) manipulated.

This is precisely why we don’t use earnings as the fundamental screen in Maximum Profit. Instead, we use cash from operations — a figure that is much harder to manipulate. This is the actual cash that the business generated. It is the lifeblood of any company. It is the money a business uses to buy new factories, pours into research and development, or delivers back to investors through dividends and share buybacks.

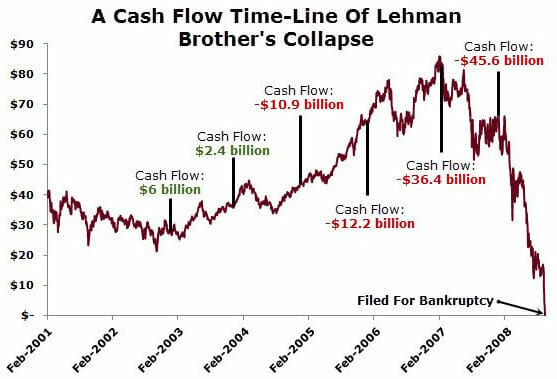

In that previous article, I once again shared a chart that I have brought up countless times. It’s a cash flow timeline of Lehman Brothers, leading right up to the firm’s collapse, which helped usher in the global financial crisis.

Companies need cash flow more than earnings to survive. Remember, Enron had earnings but lacked cash flow. And it turned out it was manipulating its earnings figures to dupe investors.

The bottom line is that when one of the world’s greatest investors warns you to be wary of earnings, he might be on to something.

P.S. How would you like to get paid every month from your portfolio? It’s easier than you might think…

My colleague Nathan Slaughter makes it his business to research the best income payers the market has to offer. And he’s finding dozens of high-yielding monthly dividend payers out there that most investors don’t even know exist…

In his latest report, Nathan reveals 12 of his favorite monthly dividend payers offering market-crushing yields. You could start receiving payouts every single month! Go here now to learn more…