Why Investors Shouldn’t Forget About This Well-Known Blue-Chip Stock…

It may be the “old dog” in our portfolio over at Capital Wealth Letter, but it has continued to deliver.

I’m talking about Cisco Systems (Nasdaq: CSCO).

The company released quarterly results on February 15. And once again, it topped analyst expectations.

During its second quarter of fiscal 2023, Cisco pulled in nearly $13.6 billion in sales — a 6.7% year-over-year growth. Earnings per share of $0.88 beat the Street’s estimates by three cents.

Cash from operations checked in at $4.7 billion, a 92.5% improvement over the same period a year ago. Once we account for capital expenditures, Cisco’s free cash flow was over $4.5 billion, a 94% growth.

I’ve been impressed with Cisco over the years. It has continued to innovate and remain the dominant player in its space.

This isn’t always the case for premier companies like Cisco. Oftentimes companies like this sit on their laurels, becoming complacent and allowing competitors to eat away at their market share.

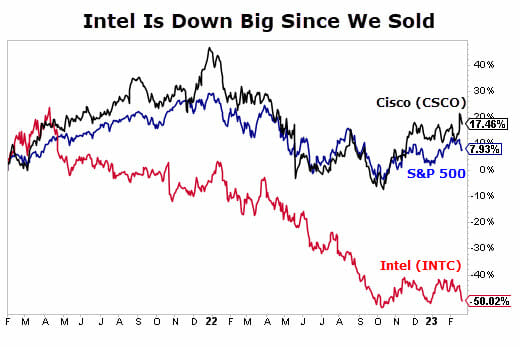

To see what I mean, take a look one of our former holdings, Intel (Nasdaq: INTC).

What Happens When Blue Chip Stocks Lose Their Edge…

Intel was a staple in our portfolio for years over at Capital Wealth Letter. But here’s what I told our readers when I removed the stock from our portfolio:

After nearly a decade in our portfolio (first recommended in September 2011), Intel has done well for us.

But I’m cutting ties for a simple reason: I don’t want to be holding the next International Business Machines (NYSE: IBM).

In short, I was growing worried that it was becoming the next “IBM”- a zombie-like stock that greatly underperforms. Take a look at the chart below to see what I mean…

This has to be one of the most frustrating charts you will ever see. This iconic American company, the bluest of blue-chip stocks, has essentially been dead money over the past 10 years. Yet, for some reason, investors keep giving it the benefit of the doubt.

(I wrote more about “zombie” stocks back in January.)

Intel was a similar story. It is about as “blue chip” as you can get. But the truth is, the company had been struggling to right the ship for years. Here’s how I summed up the problems that were plaguing INTC back in 2021:

The biggest problem: Intel still hasn’t shipped a single 10-nanometer chip. This has been a four-year delay now. I gave the company the benefit of the doubt. But while Intel was stumbling through its manufacturing missteps, competitors didn’t just walk by, they ran by Intel.

I’ll give you an example. Taiwan Semiconductor (NYSE: TSM) is already working on 5-nanometer chips — an entire generation ahead of the Intel chips that have yet to ship.

Then a few months ago Apple decided it no longer needed Intel to produce chips for some of its products. Instead, it’s going to design its own chips and have TSM manufacture them. And from what I’ve read, Apple’s chips are already far and away better than Intel’s…

In short, Intel has fallen way behind its competition, and it’ll take some time for it to catch up. If it ever does.

This is why I recommended we book our profits on the stock (158% return) in January 2021. It was the right call, as Intel has floundered since then…

As you can see, Intel lost 50% since we sold. Meanwhile, Cisco has outperformed the broader market as measured by the S&P 500.

But that’s been the case for years. Remember that 10-year chart of IBM? Now here’s how Cisco has done…

Closing Thoughts

I like to call Cisco the “backbone of the internet.” That’s because it is the leading seller of hardware for shuttling data along the information superhighway (think switches, routers, and servers).

The numbers reveal that spending for tech infrastructure (think servers and networking devices) is holding up well. Many analysts were concerned that this segment would soften as the calls for a recession grew louder. But that doesn’t seem to be the case yet.

Cisco is not making the same mistakes as IBM or Intel. And investors are profiting handsomely for their trouble.

Cisco may not be the first name in tech that comes to mind for most investors. But it remains a solid holding for just about any portfolio. If the stock dips below $46 per share, you should consider buying it.

In the meantime, my team and I have just released a report of “shocking” predictions for 2023 (and beyond)…

This report is easily one of the most hotly-anticipated pieces of research we release each year. And if history is any guide, it could be one of the most profitable things you read all year…

From the U.S. dollar to driverless trucks to breakthrough cancer treatments and more… If you’re looking for ideas that could turn a modest investment into a small fortune, this is where you’ll find it.