2 Stocks That Could Raise Dividends In November

Looking for stocks raising dividends in November? You’ve come to the right place.

As longtime readers know, I make a regular habit of looking for dividend hikes each month for my premium readers. Then, I share my findings with the public.

Why do we do this? Simple: Studies have shown again and again that dividend growers historically outperform the rest of the market.

So when we look for stocks raising dividends in November, we don’t do this just for fun. As Chief Strategist of High-Yield Investing, it’s part of my job.

We’re looking for great ideas to potentially include in our portfolio… Companies posting outsized double-digit increases, and reliable dividend-payers that have been steadily growing payouts for a decade or more.

Ideally, we like to find potential hikes that could happen over the next four to six weeks. I also highlight noteworthy special distributions on the horizon. (Check out our analysis for October and September.)

This month, I’d like to highlight two stocks raising dividends in November that you might want to consider. If you’re looking for a potential addition to your income portfolio, you might want to take a look…

2 Upcoming Dividend Hikes For November

1. McCormick (NYSE: MKC)

Want to spice up your portfolio? Try this packaged foods vendor, whose products are found in millions of kitchen pantries in over 160 countries worldwide.

This is the corporate parent behind popular brands such as Lawry’s, French’s, Old Bay, and Zatarain’s. The product portfolio spans everything from barbecue sauces and marinades to cornbread mix. But the company is best known for its full line of spices, which receive prominent placement on just about every supermarket shelf nationwide.

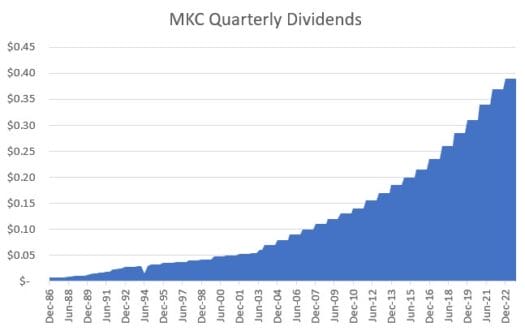

Add it all up, and the company rakes in more than $6 billion in annual sales across 170 countries. Regardless of economic cycles or interest rates, demand for food tends to be steady (see comments above). That explains why MKC has been able to raise dividends for 36 straight years – an impressive streak that dates back to 1987.

That track record was unscathed by Covid, with the company announcing a healthy 9% bump from $0.34 to $0.37 per share in November 2021 and then to $0.39 last November.

McCormick is capitalizing on the secular trend of increased at-home meal preparation, spurred partly by the rising costs of eating out. The company is still grappling with inflationary pressures and supply chain issues, which have taken a bite out of gross margins. But, these trusted brands have pricing power, and management expects to fully pass the increased costs on to consumers (a common scenario).

Sales rose 6% last quarter, reflecting both price and volume improvements. Management just raised its full-year earnings outlook to a narrow range of $2.62 to $2.67 per share. Given its conservative payout ratio, I expect this Dividend Aristocrat to treat shareholders to another hike by the end of November, possibly boosting payouts to $0.42 per share.

2. Mid-America Apartment Communities (NYSE: MAA)

Mid-America is the nation’s largest apartment owner, with a portfolio of 300+ complexes containing more than 100,000 units. Most are located in desirable markets from Florida to the Mid-Atlantic region. Particular emphasis is placed on cities with strong population growth and job creation, such as Orlando, Nashville, and Washington, DC.

Mid-America has enjoyed steady occupancy, rising rental rates, and an expanding portfolio. This has provided the financial fortitude to support 118 consecutive quarterly dividend payments over the past three decades.

Throw in capital appreciation, and MAA has delivered annualized total returns of 15% over the past 20 years, outpacing its peer group average by nearly 400 basis points.

As we have discussed, soaring home prices and spiking mortgage rates have made homeownership unaffordable for many, expanding the ranks of “renter nation.” And this well-positioned apartment landlord is reaping the benefits. With demand outpacing new supply, MAA squeezed nearly 9% more net operating income (NOI) out of its properties last quarter.

The latest outlook calls for funds from operations (FFO) to hit $8.22 per share this year, an uptick from prior guidance. It doesn’t hurt that new and renewal leases are being signed at considerably higher rates. Management also intends to plow more cash into acquisitions this year, adding thousands of new units, while also entering into joint venture partnerships to raise funding for its lucrative redevelopment pipeline.

All of this (coupled with a stout investment-grade balance sheet) points to sustained distribution growth… as we’ve come to expect.

Back in 2019, I predicted an increase in the quarterly payout from $0.96 to $1.00 per share. And the company delivered – to the penny. Despite the challenges of collecting rent during a pandemic, it continued to tack on to distributions in 2020 and 2021. And as conditions improved, dividend growth accelerated last year, with the annual payout hitting the $5.60 per share mark.

With low turnover and robust leasing trends, I anticipate another double-digit dividend hike next month.

Action To Take

We’ve had a pretty good run of finding solid ideas from this exercise, so it pays to follow along each month. Some of them end up paying off big time. So, if you’re on the hunt for stocks raising dividends in October, these suggestions are a great place to start your research.

But remember, just because I highlight stocks that are likely to increase dividends doesn’t necessarily make them “buys.” These are merely ideas to get you started in the hunt for high yields.

And if you want to know about my absolute favorite high-yield picks, you need to check out my latest report…

You’ll learn about 12 ultra-generous dividend payers that put more money in your pocket. And the best part? They pay dividends monthly. Go here to learn more now.