Jobs, Inflation, And Calling It Quits… Plus: The Hottest EV Company On The Planet

Well, folks, I had to drop the truck off at the body shop a couple weeks ago.

In normal circumstances, it would probably take just a few of days to make the necessary repairs. But due to supply shortages, I have no idea how long it will take for me and the trusty pickup to be able to hit the road again together.

In the meantime, I recently found myself with a little bit of truck envy.

I’ll explain why in just a moment. But first, it’s been a little while since we’ve covered some important economic data, so let’s tackle that first…

Jobs, Inflation, and Quits – Oh, My!

On November 5, the Bureau of Labor Statistics reported that 531,000 jobs were added in October. That’s a great initial reading and a big surprise over the 450,000 that were expected.

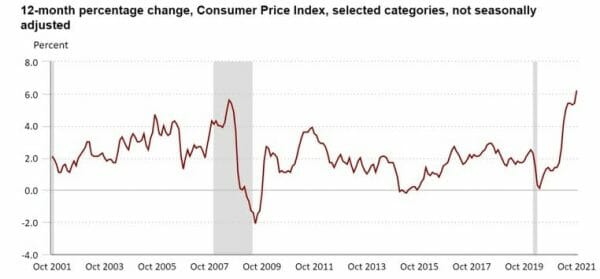

In other news, the BLS also gave us some fresh inflation numbers to complain about. I’m kidding, of course, but we’re kind of moving in the wrong direction here…

The consumer price index (CPI) jumped 6.2% on a year-over-year basis in October. If you’ll recall, last month’s reading was 5.4% in September. It’s also the largest annual increase we’ve had in 30 years.

Source: BLS

The core CPI, however, rose 4.6%, compared to the expected number, which was 4%. Core CPI strips out food and energy prices, which the good folks at the Bureau point out can be more volatile (duh). So there’s that.

Circling back to jobs, we also learned that a record number of Americans are also quitting. According to the BLS, a record 4.4 million Americans quit their jobs in September. That’s about 3% of the workforce, and up from 2.3% in February 2020 before the era of Covid lockdowns, masks, social distancing, and other restrictions would change our lives.

As The Washington Post notes, this continues a trend we’ve been seeing for a while now. And part of the blame can be assigned to the Delta variant of Covid.

But before you chalk it all up to the virus, I have to say, something bigger is going on here. As The Post points out, retirements among older Americans have also picked up. And aside from health and safety concerns, many workers are leaving jobs for reasons like better pay, childcare, or lifestyle preference (i.e. “this isn’t worth it anymore”).

If you read between the lines, I think the millennial generation is also a major factor here. Some of you may not realize it, but this generation is now our largest generational cohort. And as the generation that makes up the bulk of consumers and workers, their attitudes and preferences will set the tone for much of our social attitudes, politics, and economic habits going forward.

My colleague Jimmy Butts wrote about this idea in greater detail here. And it’s a topic we’ll have to explore more in future issues. In the meantime, however you slice it, Covid has forced a lot of us to rethink our lives. It will be interesting to see how this continues to play out, as well as the economic ramifications, in the years to come.

The Hottest EV Company On The Planet: What You Should Know

Move over, Tesla. There’s a new game in town – and it just went public.

Say hello to Rivian – an electric vehicle company that made its debut on the exchanges last week. The company raised $11.9 billion in its IPO, making it one of the most successful public offerings in years.

As of right now, Rivian market capitalization is $127 billion. That makes it the third-most valuable car company in the world. Ford’s market cap is $79 billion, and GM’s is $93 billion, for context. (Ford has a 12% stake in Rivian, by the way.)

Oh yeah, and its only delivered about 150 vehicles, with about 55,400 preorders, as of last week.

That’ll likely change soon, however.

Car enthusiasts may have had their fist introduction to Rivian by watching a show called Long Way Up on Apple TV Plus. The show is a continuation of a series featuring Hollywood actor Ewan McGregor and best friend Charlie Borman as they trek around the world on motorcycles, along with a film crew documenting their every move.

In this installment, the two friends make the journey from the southern tip of South America to all the way up to Los Angeles (get it? Long way up…). Only this time, there’s a twist.

This time, the two friends take a pair of customized prototype electric motorbikes, courtesy of Harley Davidson. And for the support vehicles, the film crew uses trucks provided by Rivian. The company also set up charging stations at 140 locations along the route.

It was a PR coup for Rivian, to say the least. So what exactly is Rivian all about?

The Rivian plant in Normal, Ill. is housed in a 2.6 million sq. ft. facility that once belonged to Mitsubishi

A New Kind Of Truck

Founded in 2009 by MIT engineer Robert “RJ” Scaringe, the company’s primary focus is to develop and manufacture autonomous electric vehicles catering to the “adventure”-minded driver, as well as a commercial van for the urban delivery market.

For the adventure driver, Rivian has developed two vehicles, the R1T truck and R1S SUV. Production was delayed due to Covid, but the R1T began deliveries in October. The commercial van is currently being developed for Amazon (which has a 20% stake in the company), which reportedly has an order for 100,000 vehicles.

Rivian R1T highlights: EPA est. 314 mi. range (400+ Jan. 2022), 0-60 mph in 3 seconds, quad motor AWD, 11,000 lb. towing capacity

Underpinning Rivian’s vehicles is some pretty impressive technology. I won’t bore you with all the details, but one of the real innovations here is the company’s “skateboard” platform, which features two dual-motor units mounted on each axle. As this piece from Autoevolution highlights, it is “capable of delivering power instantly and independently, giving the vehicles precise traction in any condition while providing significantly better torque control than conventional locking differentials.”

Translation: incredible torque, badass off-road capability, and the ability to build out Rivian’s vehicles all on the same platform. And aside from that, Rivian’s vehicles have all of the luxury and tech gadgets you could think of (and a few you won’t expect).

The Bottom Line

Back when Ford debuted its electric truck in May, I told you that it was going to be a game-changer. Since then, shares are up 58%.

But Rivian will have a long, tough hill to climb in order to reach viability. So I wouldn’t touch this stock just yet. We’ll need to see much more from the company to demonstrate that it’s a viable, investible, going concern. You know, things like orders, revenue, customers, etc…

Those are all coming, of course. Rivian is smart for sticking to trucks and fleet vans right now. The three most popular vehicles in the U.S. are all pickup trucks. And large companies are facing increasing pressure to de-carbonize their fleets. Plus, I have to say, I think the R1T is the most compelling electric pickup truck that I’ve seen so far.

But I don’t yet know whether Rivian will get there. It’s entirely possible that it does, and even gives Tesla and the other auto giants a run for their money. After all, some very smart people (like Jeff Bezos, for example) clearly see the potential.

But what I do know is that EVs are becoming more and more commonplace…

And rather than trying to pick the winners, we can play the growing EV trend by investing in the materials critical to making them.

I’m talking about lithium. The silver-white metal is crucial for a variety of industrial applications. The biggest growth driver for lithium is the demand for lithium-ion batteries used in EVs. Some pundits refer to lithium as “the new gasoline.” Renewable energy also requires a massive amount of lithium.

However, demand for lithium is outstripping supply, which is great news for the companies that mine and process the metal. For details about America’s number one lithium play, click here now.